The Legislative Budget Board has released its actuarial impact statement on HB43, the bill to ‘reform’ the City of Houston’s employee pensions. You can read the statement online or download a pdf to read it offline.

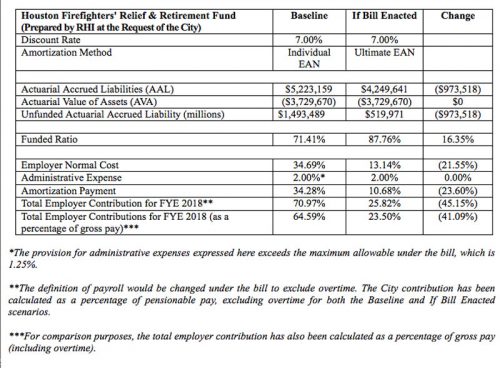

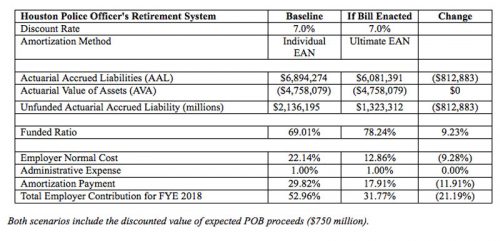

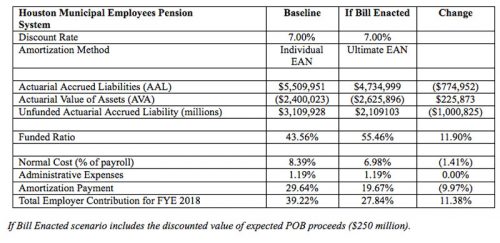

I clipped the charts for each of the plans:

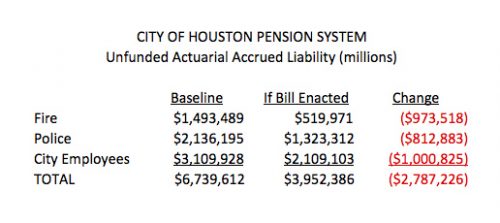

If you combine those three statements, you get this:

As you can see, at present the bill reduces the total liability by $2.8 billion, close to the $3 billion that Rep. Dennis Paul mentioned earlier. I’m not informed enough to comment further but there are some very good comments here and here and I hope those commenters chime in after reading the impact statement.

I received an email this morning from a firefighter that prefers to stay anonymous. I think that it is worth sharing.

Thank you for accepting my email, although we disagree at times, for the most part I read all of your articles and couldn’t agree more with the state of Houston politics.

Since rules I work under prevent my from identifying with my employer, I will just say that I am a lifetime Houston resident and one of the few in my organization who is a city voter. I have been a member of HFRRF (Firefighters Pension) for 13 years.

Some quick facts I wish every resident knew. Our fund is the #1 rated fund in the state, a TOP 20 fund nationally. Houston says their unfunded liability is around 8 billion dollars. Our fund is just 18{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} of that problem. FIrefighter benefits are just 2-3{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} of the city budget per year. 75{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} of our funds assets have been made on member contributions, and we ALL have no option, but to pay 9{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} of our pretax amounts to the fund, every check, every time.

Firefighters are consistently the #1 rated service provided to city residents because regardless of staffing, manpower, weather, etc, the service is always available. It is all done on a skeleton budget and often with equipment that is ancient in terms of the fire service and in comparison with surrounding departments.

But lets stop with “emotional pleas”, because that’s not what I am here for. Firefighters want pension reform for the city. Why would we want to push towards bankruptcy in protection of our benefits? These attacks by the mayor in media and in city council meetings make absolutely no sense. If anyone missed it, he threatened the widow of a District Chief who served 34 years before his death due to cancer, that without reform “her check would stop.”

Our members agreed to work with city negotiators to pay our 18{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986}, and balance the books of the city. But is it a far fetched question to ask of ANYONE, that if you went to the finance department to buy your vehicle and suddenly the price skyrocketed and the original deal was off the table, would that person not be upset? Our 18{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} suddenly skyrocketed up to 35-45{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} to make up for the balances of pension funds the city mismanaged for years.

Add in to that equation a city generated “Corridor Plan” which could continue to cut active firefighters benefits every 3 years. Now these cuts aren’t just diminishing returns like a bad investment would get you, these would actually cut into members paychecks, every 3 years, in a department that has not have a net pay raise (because our 1{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} was quickly eaten up by insurance costs) since 2008.

On top of all of this, the mayor wants to saddle our taxpayers with a 1 Billion dollar pension obligation bond, using our name, but our fund not actually receiving 1 dollar of that. That money would be for the deficits created by city managed municipal and police funds. Sorry that we don’t like being listed as a cosigner on someone who chronically mismanages their debt.

Pension reform would benefit city employees the most, look no further than Dallas to see what the collapse of pensions look like. As it stands now, the city can comprehensively reform the municipal and police pensions through their meet and confer agreements. Our Chairman of HFRRF has stated, over and over than our fund would do the same, but all we are asking is for a fair deal. We NEVER traded pension benefits for pay raises. That’s why almost every paid department surrounding Houston is paid noticeably more rank for rank.

Please understand these facts when we are faced with media attacks and ultimatums, or when we are painted as greedy or trying to railroad Houston taxpayers.

Please email or call your state representatives, and ask for one thing, a deal that has actually been negotiated by both parties. That alone will allow for a deal to be done that is fair to firefighters and beneficial to the Houston taxpayers.

I too like your articles most of the time. One correction is the incorrect numbers regarding the unfunded liability for for. It shows 973 million but the number agreed to by the Firefighters Pension Board was 802 million. That figure represents 18{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} of the unfunded liability. But with the 973 million figure it spikes us being responsible for around 39{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} of the unfunded liability. Those additional cuts were placed in SB2190 at the midnight hour by the Mayor before it was on the agenda for comments from the public on March 20. Those unfair additional benefit reductions are still in both SB2190 and HB43. The Firefighters are still fighting to have those extra unagreed cuts removed and corridor plan revisions that are unacceptable. We never advocated status qoa- but they keep changing the goalposts on us and the Mayor walked away from the negotiating table mid February and said in the City Council meeting April 18 “This ship has sailed” and we would have to take our requested changes in the bill to the legislators. That is what we are doing!

Dear David,

I’ve enjoyed a lot of your perspectives presented in this blog, your willingness to go beyond emotional pleas helping to get to the core of many conservative matters. In this particular case, you felt the need to include such emotional content that falls short on facts, much like Don has done of late as well. With absolutely no disrespect intended, I do not think such one sided inclusions assist in weighing the pros and cons of the proposals before the legislature, the numbers in the tables displayed from the report all provided by as good a source as you will find.

In recent comments, the barrage of comments stating how one of the pension systems should be referred to as the adult of all discussions included such fantasy numbers as being funded about 90{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} or more, the real numbers I presented showing that conservatively looked at, they were nothing close. We now see that pension is 71{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} funded so rather than address that fact, the latest song and dance is applied by an employee directly benefiting from the system. We’ve also been told by like minded employees how someone with over 40 years of service cannot qualify for a house loan, no mention of their incredibly large deferred lump sum obtained that could buy most homes in Texas outright several times over.

Their other approach is to suggest a direct comparison to other Houston employees or those from better paying cities, neither of which was compelling given the dire circumstances of this rapidly growing debt, they seemed to overlook the fact that if the city was declared bankrupt as Don has suggested several times, all three pensions would be at risk as would every service their city provides. Stepping back for a moment, I always have more questions from those that oppose securing their own future by attacking that of others, but even the slightest bit of research proves most of what they claim is just not true. Most state senators are aware of the embellishments so I find it heartening that many hold steadfast to demanding all new employees move to defined contribution plans moving forward, they just need to take the logical step and declare that in the public interests all employees should be moved to such plans as well.

If any of the employee groups wants to bet they can obtain unrealistic market results moving forward, I suggest they be severed from any funding agreement that draws additional taxes. If they are correct, they will reap the benefit of some determined level of core funding and if they cannot obtain a net average of 8.5{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986}, they can immediately cut benefits or increase employee contributions to make up the difference. That would be their personal cap to live with. What they want of course is to reap the benefit of an artificially high discount rate but none of the risk. Can we as conservatives at least agree that is unfair to taxpayers? The city’s corridor provision sounds questionable enough but if all these employees believe their pension will obtain the discount rate consistently, they should have no concerns for additional cuts.

Sincerely, Olivia

PS: I hear mentioned a lot of late how some employees traded raises for pension cuts yet I cannot find a credible source supporting the contention. I think it was Senator Huffman’s staffer explained that this is a smokescreen since no such agreement was ever made, the union groups that negotiate raises not the same as the groups that negotiate pensions. If any of you can provide a city ordinance, state law, or other official document supporting this contention, I will appreciate it.

PPS: How some employees can contradict their own certified pension reports and make wild-eyed statements unsupported by the facts just shows desperation on their part. Pay them what is reasonably owed and if they are unhappy with the modified compensation moving forward, they can apply to all these other departments that supposedly pay much better. The world will keep spinning, honest.

Dear Olivia,

First, thank you for reading and commenting. I’ve learned quite a bit from your research.

Emotions are a very large factor in politics. People sitting in a room crunching numbers certainly provide valuable information to decision makers. But in politics, decision makers have to weigh much more than numbers, especially when the decision literally involves taking money away from people that it was promised to. Doesn’t mean they aren’t going to do it, doesn’t mean they shouldn’t do it, but it does mean that it is a significant factor in the total calculation.

We have seen emotional arguments from both sides of this issue. The employees who expected to receive something that was promised to them as well as the taxpayer who has to foot the bill. Or the state officials who absolutely do not want the largest city in Texas to file bankruptcy on their watch.

I wish it were as simple as putting numbers in a formula, spitting out a result and going home to enjoy BBQ.

DJ

“I hear mentioned a lot of late how some employees traded raises for pension cuts yet I cannot find a credible source supporting the contention. If any of you can provide a city ordinance, state law, or other official document supporting this contention, I will appreciate it.”

Olivia, you won’t find it because it doesn’t exist. At the time, the police pension board and union board were at each other’s throats. I believe the police were given better pension perks than the city could afford as a means to retain personnel, especially after 9/11, but those formulas were then lowered drastically so they only impacted a relatively small number of workers. The raises they received also favored seasoned workers so the true costs were not immediately evident, only recently did junior officers get a boost to assist with hiring, those in their academy still paid in the mid to upper 20 thousand’s until then. Otherwise, all city unions negotiate direct pay and benefits while their pension boards only negotiate pension matters, each taking a narrow viewpoint by design. There were no deals to trade one for the other though naturally when you increase pay you will increase pension costs, raises designed to favor senior staff having a much greater impact on pensions as the workers contributions are based on pay throughout a career while pension benefits are based on either the last few years of a career or cherry picked pay periods, at least in a DB pension plan.

In any case, it is not fair to say that a group traded one form of compensation for another without an actual trade taking place. This in no way addresses the other issues brought up; voters have every right to express their desire to vote on big ticket items, workers have every right to expect to be paid what was promised for work already done, and elected leaders have every right to modify compensation moving forward given the changing circumstances, but no matter what happens in Austin, a lot of people will be mad.

Mrs (or Ms) Parsons I’m sorry for not knowing the correct title to address you by,

In January the State Pension review Board released its report with the ACTUAL numbers released by the HFRRF (FIrefighters pension system), the firefighter pension is 89.37 percent funded).

you can find all of that information here:

http://www.prb.state.tx.us/txpen/wp-content/uploads/2017/02/2017-Primer-Final.pdf

The numbers listed here are from a city estimate, admittedly talked about by the mayor in the last city council meeting.

The firefighter pension chairman had an initial agreement with the city to lower the target rate, but in the letter above, you can see and know through media release that the city pulled its deal and is unwilling to negotiate a fair deal.

Here are the returns for the firefighter pension fund, once again please fact check with the State Pension Board’s report

http://www.prb.state.tx.us/txpen/wp-content/uploads/2017/02/2017-Primer-Final.pdf

3 Year 9.81{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986}

10 Year 7.72{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986}

30 year 9.95{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986}

So aside from the 2008 crisis, the number of 8.5{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} has and is currently being met by the firefighter pension.

The Corridor:

The concerns about the corridor have nothing to do with fund performance, why would any firefighters be worried. As I proved here with numbers and facts, the FIrefighter Pension would have exceeded expectations and actually INCREASED benefits with a factor of the new 7 or 7.5{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986}

– The issues are the corridor as written gives a city, one we both agree mismanages money, complete indemnity for CAUSING situations that could enact a mandatory cut.

What if 1,000 retirees retire and the city refuses to hire more= contributions drop=cuts

Any pay increase comparable to other State Department= cuts

You see, there is too many moving parts, more than I can even list here that could enact the plan. I am a fiscal conservative, I can tell you are too, would you seriously want the city given unilateral legal protection with its past track record of decision making?

Worse of all, the corridor has severs constitutional issues in it. The ramifications of a successful lawsuit, after spending years in the courts, could be devastating on Houston Taxpayers.

Why would Houston FIrefighters put taxpayers in Jeopardy? With out them their salary is nothing!

Towards emotions, Maam those are facts.

The pay scales of National and Texas Departments support it. Cities around Houston do not have the problems we do because they have City Managers, that often times exceed the tenure of politically driven elected officialy looking to kick the can down the road past their terms.

In 2004 HPOPS, the police pension, agreed to meet and confer with the city of Houston. In meet and confer sessions in years after that (Public Record through Freedom of Information Act) Pension payments were argeed to be delayed. Now I guess there is no specifically drawn line, but after those pension deferrals suddenly police salaries shot up. That ROYALLY was screwing taxpayers, because now they wer paying more up front, for more debt they were accumulating down the road. Right now a police officer makes 20-30{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} more than a firefighter.

The city was forced to pay our pension bill every year, and salaries have stagnated. But ask any one you know, We would all stay right here, willing to work for you, for a stable retirement (though in your own emotional statement, you hinted that it was lavish enough to pay cash for property and homes.)

We want reform for you the taxpayer, we want to end increased city contribtions, but forcing someone to use more than what they owe…. there is a word for that…. its called stealing.

A Fiscal Conservative Firefighter

Mayor Turner continues to state that the City of Houston owes the Houston Police Department millions of dollars, and the City of Houston’s pension reform bill will pay that money owed. Houston Police enjoy the salary of the attached pay scale. Houston Police make 30-40{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} more than equivalent ranks in the Houston Fire Department and have enjoyed that pay disparity for over 15 years. The City of Houston might owe the Houston Police the money, BUT it’s not the Houston Firefighter’s that owe HPD the money. Of the three pension systems, the Houston Fire system is 15-18{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} of the unfunded liability, yet Mayor Turner’s reform/corridor bill wants fire to cut benefits 39 to 40 something {997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} percent. The most troubling part about the unfunded liability, is that it all depends on who the bean counters are and numbers systems being used.

Vote against HB-43 and Senate Bill 2190

Let’s talk muni and police pension systems: In 2001 David Long who is back in charge of muni pension system now under Mayor Turner. Had the Texas Legislature pass a two years of pension seniority for each year of service, doubling staff and elected official’s pensions.

The police pension system had a one check, two week pay period, to base their pension checks. This benefit spiking resulted in inflated pension checks. In Fact, Mayor Lee Brown gave an out going Police Chief a large raise his final week that inflated his pension checks $9000. HPD’s salaries are 30-40{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} more than equivalent ranks in the HFD, so don’t tell Firefighter’s they have taken money from HPD.

So I agree the the Fire Pension system are the adults in the room.

Dear Anonymous Firemen,

Since you are relying on people to refrain from researching the information provided, I will just say this one more time. The link provided by the allegedly fiscal conservative employee is to a state report that listed numbers provided by various pension systems, The numbers were not analyzed by the state’s Pension Review Board and relied heavily on the pensions making their target goals. HFD’s was data from 2015. The data I provided in a previous response was from last summer out of the same pension fund’s own annual report generated by their hand selected actuary which claimed that as of last summer, their pension was 80{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} funded using an 8.5{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} discount rate. This latest report David provided is using a discount rate of 7{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} which greatly increases the unfunded liability of the fund. No true conservative will argue that an 8.5{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} discount rate is appropriate for a secure pension fund, nor would any true fiscal conservative argue with the benefits to taxpayers of a defined contribution pension.

In any year where a pension fund does not make the promised return, in this case a net of 8.5{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986}, it in effect loses money. In 2015, their fund netted under 1.3{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} and in 2016 it netted a negative 1{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986}, for a three year average of 6{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986}. They used older data on their website to trick people but there’s the truth. So in the previous three years when 8.5{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} was expected every year, even looking at it with simple math which favors their stance, the expected 25.5{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} was 15{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986}. Also per their own report, dropping the discount rate a mere 1{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} will increase the unfunded liability by over $1.3 billion, the report posted by David using the projected 7{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} rate agreed upon. So if your fund can easily make 8.5{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} all of a sudden, something your own pension board does not believe, you will be safe from any corridor provisions tied to performance based on 7{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986}.

The continued comparison between different types of employee again falls flat too. Both jobs are dangerous but have completely different skill sets as discussed previously so I’m not going to repeat myself from the other thread. If I were your employer, I would want to know why you deserve a specific salary rather than why someone in accounting may be paid differently and how much you would like what he was being paid. And since when is it an emotional rebuttal to point out that a 43 year career employee complaining how he couldn’t qualify for a loan was not telling the truth given what would certainly be a windfall amount in deferred funds on top of a sizable pension with a yearly cost of living adjustment? In my circles, possessing at or close to a million dollars in a financial account along side a large monthly check would qualify you for most homes in Texas, the median value of a home these days well under $200k.

By all means mislead the public as you see fit but I suggest anyone that wants to inform themselves of the truth can read any of the three pension reports, contact the Chairman of the state Pension Review Board for more details, or contact Senator Paul Bettencourt’s office for some well written literature on the subject. Lacking a defined contribution component moving forward should be the litmus test between the wishful thinking employees trying to hold onto our wallets and true fiscal conservatives, ending deferred programs immediately and ending cost of living adjustments until pensions are caught up a second condition worth consideration. I’m out for the weekend so whatever fuzzy logic the employees continue to post can be addressed by others, the facts do not change no matter what their spin.

Sincerely, Olivia

Who to believe? When special interest groups provide data that is clearly in their favor, it is data they wanted to show to make their point. That doesn’t mean the data is reliable.

Houston has a pension mess on its hand. It is one the city created. When several of my HPD buddies showed me their retirement benefits, I couldn’t believe what I was seeing … but I was happy for them. I love cops and firefighters, but let’s be honest. The city caved into the exorbitant demands of the HPD and HFD unions without considering the long-term consequences.

Mayor Turner’s plan will not solve the pension mess. It will just be a smaller can to kick down the road. His plan will cost everyone – the firefighters, Houston cops, other city employees and, of course, the taxpayers.

Olivia , I couldn’t qualify for a loan. I retired as an E/O, not a deputy chief. I don’t qualify for Medicare, or Social Security and over $1800.00 a month for City insurance (medical, dental, vision) right off the top of a an E/O pension check. I recieved one COLA since retirement last June. The DROP account is not considered in applying for a loan, not an income stream. They only consider monthly income stream. Supporting 3 people, sorry you have to sell your home first, which is paid for, both cars paid for, good credit score. At retirement I was making less than $25.00 an hour after 43 years. The direct result of little to no raises and rising insurance costs. So no hefty pension check going to my bank account.. sure I could take money out of my deferred account and give most to Uncle Sam. Loan officers know what’s going on, the drop account could go up in a puff of smoke including the 9{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} of every paycheck I contributed to my pension. That’s a lot of money over 43 years. So don’t tell me I’m not being truthful. Every word of trying to get a home loan is/was true. My pension check is not enough for a $200,000 loan.

Dear BJ,

Since you left out your gross monthly income from all the other data provided, I had to fill in the blanks using available data from your own pension report. If you retired last June, you are one of the fellows that were in the over 30 year category mentioned in your pension report that averaged over $61000 in retirement, complete with subsidized medical coverage. That means you were available to take advantage of using overtime and other special pays to leave making as much or more than when you were working. While you are mistaken regarding how many raises you were given over the previous 43 years, you also fail to mention how much your deferred retirement account and the value of your current home. Be mindful that lenders will only want you to gross $50k a year on such a loan, hardly a problem for you.

Now that you are retired, you may withdraw money from your deferred account to place it in a traditional IRA and take a loan from it, effectively borrowing your own money, if you don’t want to part with any of the money you received. That you want to have your cake and eat it too is bad enough but the suggestion that your account could simply disappear is simply not true and we all know it, including lenders. Otherwise, to leave that money alone, you could also apply for a HELOC, a line of credit based on your existing home that is already paid off. Your good credit and guaranteed level of gross income would of course be enough on their own if you had a sufficient down payment to avoid PMI but given the particulars, I believe the interest from your deferred account would be more than enough for any such home loan without touching your monthly check.

In short, get better financial advice from a professional. You are in your 60’s with a retirement income more than the average worker currently makes, good credit, all your fundamentals paid for, and a large lump sum of money earning above market rates. In all of these reform talks, nobody is planning on lowering your current check or taking away a penny of your accumulated wealth so the claim you are so bad off raises eyebrows.

Sincerely, Olivia

Lidia, would it upset you to know that many county employees are making over $100k/month in retirement? Does it bother you how legislators are getting full Cadillac pensions based on judge pay though they only work a few months a year in a job that pays $7200/yr? Not everyone wants to cash out their life savings to buy a house outright in their twilight years since they will have to pay the maximum tax rate. KPRC reported tonight that the Calendars Committee has moved forward with this whole claw-back of benefits so the real heat is about to be unleashed, Mayor Turner’s threat to lay off fire and police likely to backfire on him.

I wish some of this so called fiscal conservative were as concerned with the federal debt, a city goes bankrupt no big deal, our country goes bankrupt that is one heck of a big deal.

Little people have little minds that can’t see the forest because of the trees.

There was a reason that the Roman Empire took care of its poor.

http://www.pbs.org/empires/romans/empire/plebians.html

or if you prefer

https://fee.org/articles/poor-relief-in-ancient-rome/

But one could also look to French history

http://www.historydiscussion.net/world-history/french-revolution/causes-of-french-revolution-political-social-and-economic-causes/1881

or if what prefers they can find it in the Bible

While attention is directed at the local scene is used to divert our attention away from where the real fiscal problems seem to be, the federal government. and to a lesser extent the state government.

Trump and the Republicans seem to be heading toward a Kansas type mess and so called fiscal conservatives seem to have their eyes closed.

The State is suppose to fund education instead it is taking money from some school districts to give to others.

Yes the City messed up but why the focus only on the City and often by many that do live within its boundaries?