Note: sheet flooding is flooding from sheet flow; which is the main type of flow that causes street flooding.

With the upcoming flood bond election later this month, and a vote on the language regarding the rain tax in November, this is a good time to take another look at the flooding issue.

In Harris County we have three different types of flooding – river, sheet, and storm surge. The upcoming elections will only directly address river and sheet flooding, but depending on how the river flooding is addressed could have an impact on storm surge flooding in Harris County.

Much of the current focus/discussion has centered on river flooding. That’s what the election this month is slated to address. While devastating to those impacted, river flooding (and storm surge) only impacts a small segment of the county. Sheet flooding, which is supposed to be addressed by the rain tax, has far greater general disruption to the county. Voting in favor of the flood control bonds later this month seems like a wise course of action. Voting in support of the rain tax in November is a much more open question.

Climatological Rainfall Data – increased precipitation is not causing the floods

For starters, it’s a good idea to look at climatological data to see if increased precipitation or increased urbanization is causing the flooding issues. Much of the data being presented in the aftermath of Harvey focused on Bush airport. However, looking at Hobby rather than Bush paints a significantly different picture.

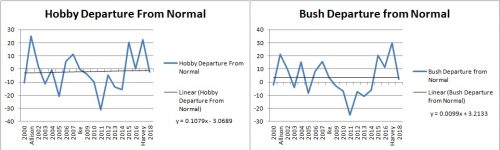

The National Weather Service has readily accessible climatological information from 2000 to the present. Bush and Hobby have some noteworthy differences over this time span. In general Hobby receives more total precipitation which is to be expected given the difference in proximity to the Gulf and sea breeze effects. More noteworthy, while Bush had 9 years of rainfall above the 30 year average and 9 years below the 30 year average, Hobby had 6 years above the 30 year average and 12 years below the 30 year average.

This is more remarkable when you consider both Allison and Harvey are within the time period. Leaving these two storms out, Hobby would have been 14 years below normal precipitation versus 4 years above normal. This suggests that, overall, total rainfall rate is not increasing at Hobby, and that any increased rainfall totals are because of named tropical systems rather than because of generally increasing precipitation amounts.

The precipitation deviation at Bush is more in line with what would be expected, with half the years above normal and half below normal. However, once again Allison and Harvey skew these results. Plotting a trend line from 2000 to the present gives a formula of y = 0.0099x + b. This flat trend line is artificially raised by Allison and Harvey. If not for these two systems the trend line at Bush would be negative.

With this in mind, the conclusion is that overall precipitation increase isn’t the reason we are experiencing greater flooding problems. That leaves increased urbanization as the culprit for the increased flooding.

The rain tax is supposed to address drainage issues

After this month’s election the flooding election turns to November when a vote on the language for the rain tax is back on the ballot. One of the biggest issues with the rain tax is the question on where has the revenue been spent. The City, so far, hasn’t given a good explanation as to where the collected funds were spent. However, insofar as the future is concerned, what are the plans for future expenditures is the critical question.

In 2016 I wrote a technical piece explaining how drainage woes lead to worsening river flooding and offered a shell of a plan on how to combat the issue. The City needs to do more in the way of sheet flood control with the rain tax if continued taxation is going to be beneficial. The two ways to reduce sheet flooding are keeping water off the streets and better drainage of water that makes it to the streets. Both of these areas are, from an engineering standpoint, very simple. Both of these areas are what the rain tax is supposed to fund.

The increased urbanization is what’s leading to the more recent drainage issues. Combating the effects of increased urbanization is simple. As was suggested earlier, a simple philosophical tweak to roadwork would go a significant way to increasing drainage. Simply installing grates in the road when roadwork is ongoing would go a significant way towards reducing the flooding.

Right now we have a situation where neighborhoods are dry, but all paths out of the neighborhood are flooded. Take Fondrin and Bellaire and Fonderin and Harwin as an example. You could get out of the neighborhood, but can’t get past either light in a flood. Essentially, the residents (myself included) are safe, but trapped in our neighborhood. Adding extra drainage at these intersections makes them passable and allows for exit from the neighborhood. Once you can exit the neighborhood then the economic impact of the floods lessens. If you can get out of the neighborhood you can get to work.

Lessening water flow onto the roads is the second piece of the puzzle to stopping drainage issues. The previously mentioned beautification plans would help lessen the impact. However, the City also has the capability to help with this task outside of business participation. Permeable concrete doesn’t work too well for roadwork since traffic speeds need to be below 35 mph in order for the permeable concrete to maintain integrity. However, this isn’t a concern for sidewalk repairs. This also could be used where driveways meet the roadways. Even a simple strip the width of the sidewalk where parking lots and the roads meet will have a significant reduction in the amount of water that flows onto the streets.

Something needs to be done to combat flooding. That’s why a vote in favor of the bonds this month is a palatable expenditure. However, the current flooding issues establish that the rain tax is not working. Unless and until the City can articulate some specific plans on how the rain tax is going to be used differently in the future a vote against the rain tax in November is the wiser course of action.

Our streets are the collectors that feed the storm sewers under and adjacent to them. The storm sewers along those streets are designed for 2 year storms. The original battle with nature was to do exactly what we did. Beginning over a hundred years ago.

We live on a Gulf Coast prairie in the tropics in close proximity to the sea. Accept that reality.

If your neighborhood in Sharpstown drained faster the people downstream from you will feel the consequences. The concept of time of concentration (time to get steady state flow, saturation) works in our favor. I will say I was the guy that got the Bintliff Ditch cleaned out two or three years ago but its growing back.

I propose getting more surface water to the vadose zone of the abundant shallow sand stratum we have below a whole lot of this city. I proposed this to at HCFCD and some were intrigued but the environmental group shut the door. I think Ft. Bend County may bite on it though.

That depends on where the water is draining. If the water is flowing through ditches etc then I agree with you. If water is draining into retention areas and/or into the soil then we disagree.

However, most of the street flooding issues are from excess runoff into the streets rather than a frank inability to drain. Have water flow into the soil thereby retarding the rate water goes into the streets and the problem is mostly resolved.

Much of the rain tax money is going to storm sewer improvements, which increase detention, and get water off of surface streets. However, this work doesn’t move fast, since it involves tearing out the street and putting 7 feet square storm sewers in place then rebuilding the street above. There are hundreds of miles of planned storm sewer replacements in addition to the work already done, Shepherd from Westheimer to Dallas is an example. I will be voting in favor of continuing the rain tax, since there’s no money to fund drainage improvements without it, although we could cut police and fire spending by 50% and free up 600 or 700 million dollars.

That’s the rub here. If the City is appropriately using the tax proceeds then great. However, the Chronicle recently noted that a billion worth of the taxes went to debt reduction rather than drainage.

Transparency and clearly articulating where the tax proceeds are going is the issue. If it’s going for drainage projects then great.

The whole system needs tweaking though. Drainage needs improvement. But we also need to shift our thinking to incorporate other measures to prevent runoff from making it onto the streets.

There are several funding sources that feed into RebuildHouston. The funds raised by the rain tax go to drainage projects under the RebuildHouston umbrella. That money is spent on streets when the streets have to be torn out to replace storm sewers, and yes, some of the money goes to pay for the costs of project management and oversight. That’s unavoidable.

Keep in mind that none of this work happens without the rain tax. I hear all sorts of moaning about property taxes, but the reality is that the property tax collected by the City of Houston doesn’t even cover the cost of police and fire, much less road and drainage work. With the revenue cap that’s in place, the City is forced to find alternative means to fund infrastructure projects, and the rain tax is one of those alternatives.

It was my understanding that the majority of the drainage fee was going to pay salaries?

These employees were not hired to work on drainage but were simply moved to a new cost center once the drainage fee was approved.

Am I incorrect?

That’s a persistent refrain that keeps coming up. I can’t tell you if it’s accurate or not. This is the type of information the City needs to disseminate.

Going forward if the City answers questions like this and can match future tax revenues with projects then the rain tax serves a good purpose. It’s the lingering questions which make a no vote in November the more attractive course of action.

I hope the City can provide information on where the funds will go before November. The hope is the lingering questions are answered and the future revenue can be matched to projects eliminating the lingering doubts about what the tax is being used for.

There is lots of data on the RebuildHouston.org website, and here’s a link to the 2017 financial summary https://www.rebuildhouston.org/documents/fy17_rh4_funding_sources_slide.pdf which shows that $12 million of the approximately $110 million in rain tax money went to project management and administration of the tax. Another $2 million went to operations and maintenance(ditch cleaning and grading, etc) for existing drainage infrastructure.

Ross,

I went to the link you provided. Over $114 million in expenditures with only 5 line items given as detail.

Not much to go on.

Fred’s right, the link gives only a little info. But what it does provide gives reason for pause.

If we look at the numbers it shows that 12.5% is going to overhead. That’s a high number in the private construction context, and even more concerning for a governmental entity which commands a government discount.

Without the discount (assuming 3%) it would be the equivalent of 15.5% overhead in the private sector. That’s way higher than the general 10% overhead cost in the private sector.

Greg, there were project management costs of $9 million, which is under 10% of project contractual costs. There’s another $2.7 million in costs to administer the tax and commercial paper fees (not sure what the commercial paper is for, maybe related to timing between billing the fees and collecting them). I would like to see a breakdown between the administration costs and the commercial paper fees, since combining the two isn’t helpful.

Ross I’m not sure how you are getting your numbers. The link provided showed:

Project contractual costs: 100,352

Expenses total: 114,757

Difference: 12.5%

In general construction should have the 10 and 10 rule. Ten percent profit and 10 percent overhead.

The City shouldn’t be making a profit off of the work so the overhead would be 10% with no profit.

The city also should command a government discount in the 3% range dropping the overhead to 7%.

That’s a 5.5% difference (whether you add it to the top or take it from the botton). A 5.5% difference is a huge variance from the norm.

How does separating the overhead into different line items change the calculation?

Greg, there is $2 million in operations and maintenance, which is not related to projects, but is the cost for City employees to fo ditch cleaning, drain clearing, and other routine but necessary drainage work. The $2.7 million is to administer the tax and pay commercial paper costs. Neither of those amounts are related to projects, and would not be considered project OH costs in the private sector.

They will collect the drainage fee no matter what. It doesnt matter if you vote yes or no.

That’s their stated intention. A no vote does place more pressure on them to appropriately spend the collected funds. More importantly, the tax could be beneficial if the City can articulate where the funds are going. Sunshine is needed.

I don’t see how an election will persuade Napoleon Turner to do anything. He is right and you are wrong. Its that simple. The vote is purely symbolic, of what, no one really knows.

Good comment.you should write the article. Clueless

Bk

As an engineer who has designed hundreds of city/county approved drainage plans, I have more accurate analysis of our flooding issues than any of our myoptic government officials or our media parrots. I have approached Big Jolly a number of times, on a range of subjects in our current, false paradigm reality. Truth is not allowed in the alternative viewpoints.

I think you meant “myopic,” but you may not have seen it clearly. Perhaps all that time admiring yourself in the mirror has affected your eyes.

The Rain Tax is paying salaries and related benefits within the public works department. The Rain Tax was also sold as costing no more than a hamburger a month ($5). My rain tax is about $20 month in my single family 2,000 sf house on a large residential lot. And the entire concept is a joke to start with. If the runoff from my driveway is causing flooding, and my house is already in a 100 year flood plain, how in heck can I contribute to flooding in a 100 year event? My driveway is already underwater. btw, our Mayor has declared the 100 year flood plain as the new 500 year level. I didn’t flood, hence why am I in any regulated flood plain?

I’m hearing the same $5 spiel on the county tax they want to pass. Note Ed Emmett is on record saying the cost will begin at about $5/month and depending on which report you hear raising to about $10 in 10 years or $55/month in 20 years.

We are doing exactly what locals in liberal bastions throughout the US have done. We are going to encumber our properties in so many taxes and fees people will leave. Using floods as an excuse to generate revenues to blow on pension debts and bike lanes is a loser’s gambit.

You didn’t understand the concept.

I’ll translate – “We need more of your money”.

Dan, $20 per month implies you have 7500 square feet of impervious cover. If that’s incorrect, you can appeal to the City to get it changed. The City used computer estimates from aerial photos to calculate the impervious area. Here’s a link, enter your address in the search box, and check the baseline impervious area and update impervious area boxes http://verify.rebuildhouston.org/prod/mydrain.htm There is an appeal process on the site as well, search for Rebuild Houston appeal.

What’s your suggestion for paying for storm sewer replacement, associated street repair, and other drainage work?

What do you suggest the City do about the pension debts(which aren’t being paid for with the rain tax funds)?

Keep giving those employees what they voted for…empty promises.

JUST SAY NO!!

There are those who search for and propose solutions, who look for ways to help themselves and their neighbors through rough times, who sacrifice a little for the greater good and who try to be part of the solution instead of an obstacle.

Then there are those who “JUST SAY NO” and think themselves clever.