The City of Dallas Pension Board voted to suspend withdrawals from the Deferred Option Retirement Plan (DROP) system on Thursday, December 8. There will be those Dallas firefighters and police officers who successfully exited the DROP system, and those that did not. There are allegations that some of the Dallas private equity investments had not been valued properly. Litigation has already erupted among the parties. There are signs of impropriety with the FBI raiding the offices of the fund administrator. Dallas is 240 miles away but a lot closer today because of the similarities with the pension systems. The classic Ponzi scheme narrative is a shoe that fits here.

It was quite a series of events that began when the Mayor of Dallas, Mike Rawlings, sought a Temporary Restraining Order (TRO) to prevent any city employees from withdrawing funds from the DROP. It was a classic run on a financial institution by definition. We generally think of runs on financial systems as bank runs. This run was on a pension fund. Dallas public safety employees, in a panic, sought to remove their retirement nest eggs before the DROP system ran out of funds.

The Mayor sought to end the run through court action in the form of a TRO. It was an extraordinary event because he did this as a private citizen, NOT as the Mayor of Dallas. There is always a high bar for a Judge to issue a TRO. The Judge in this case postponed the hearing until 3:30 Thursday afternoon until the pension board itself could meet to vote and prevent any further funds from being withdrawn. This, of course, accelerated the run and the employees chose to get while the getting was good.

Mayor Rawlings came under criticism following a pattern seen in many financial scandals. Whether you are talking about Bernie Madoff or Enron there are always whistleblowers who were early in ringing alarm bells to stop the train wreck. Rawlings appears to be one of the good guys and you can hear the frustration in his voice. Please stop and listen to this very short interview where Rawlings talks about why he filed the TRO and took the steps he did.

The complaint Rawlings is expressing is not a new one involving Texas pension DROP funds and lack of transparency. Rawlings worked for years to get auditors into the DROP fund to mark assets correctly, stating their true value. The City of Houston has also litigated with the Houston Fire pension fund over transparency.

Many fund participants knew the interest rates they enjoyed in the DROP program were not sustainable. The employees saw how fast these accounts grew. “Officers went to the board. I’m one of them who went down there and said ‘listen we can’t sustain this kind of rate,” Bailey said. Bailey is a retired Dallas Police officer. The same is true in Houston and at least one former officer has commented on this blog about the unsustainability of Houston’s local pension DROP structure. The question now is does Houston have similar problems as Dallas? Let me suggest that they do.

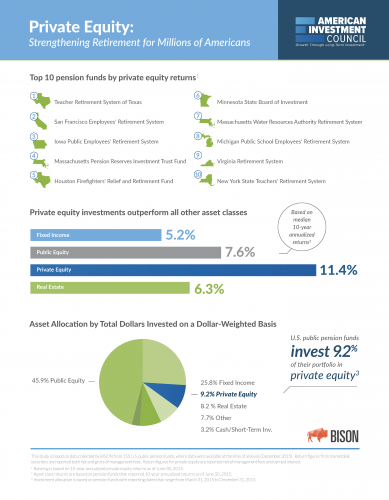

Texas public pensions have chased yield in a low yield environment. Fund managers had to do this to get the returns promised employees by elected officials. Politics and investments never mix well. Then, when you add vendors selling high yield private equity investments, you are just throwing gas on a fire. The play is always “fourth and long with minutes left on the clock”, as one seasoned fund manager told me yesterday. Remember Mike Rawlings and the lack of transparency he found in Dallas. The same problem exists here in Houston.

The Houston Fire pension system has litigated with the City of Houston over transparency. Houston officials had sought the number of firefighters retiring and the amounts owed each in their respective DROP accounts. The Fire Department litigated to keep that number secret. When the Dallas DROP system collapsed it was learned over 500 police and firefighters were owed over a million dollars and one firefighter had 4.1 million dollars in his DROP account. Obviously, the COH to be able to plan must know the benefits owed to those retiring. The City of Houston actually sued the actuary of the bogus report that led to the outrageous benefits now being paid out. The allegations were that the Towers report concluded that the city contribution would not exceed 15.4{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} of payroll – of course now it is closer to 30{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986}. I always like to read Federal Judge’s opinions about people behaving badly. Judge Melinda Harmon ruled that the case can move forward against the actuary and gives her opinion in a seven page ruling. The opinion is an interesting discussion of the background and describes the legislative labyrinth set up by the unions in protecting this now discredited report. This is all very interesting, right? The question is who created the mess.

The answer is legislators of course taking large political contributions. Mayor Sylvester Turner, the late Mario Gallegos, and Senator John Whitmire were the architects of the disaster that has  befallen the city pension system. Now that the Dallas system has crashed we now know private equity investments had a large part in that scheme and liquidity issues. Houstonians must ask themselves what is Sylvester Turner up to with his latest “kick the can down the road” scheme. The irony that Turner created the system that is currently whipsawing him financially is a problem he made for himself. However, the implications are much bigger.

befallen the city pension system. Now that the Dallas system has crashed we now know private equity investments had a large part in that scheme and liquidity issues. Houstonians must ask themselves what is Sylvester Turner up to with his latest “kick the can down the road” scheme. The irony that Turner created the system that is currently whipsawing him financially is a problem he made for himself. However, the implications are much bigger.

Turner is asking for a billion dollars in pension obligation bonds (POBs) basically for a bogus actuarial report written years ago. This bogus report obligated the city to make millionaires out of police and firefighters. The obligation will be on the taxpayers, not crooked politicians who created this mess. There have been private equity losses related to the Houston pension funds involving Towers in the Westridge case. Questions remain concerning the private equity investments in Houston and their value. The legislature needs all of these funds to be audited and particularly the private equity investments. Turner needs to be using the formidable City of Houston lobby team to seek transparency and accountability in the Houston pension system, not another “kick the can down the road” scheme. Senator Huffman, a large beneficiary of union largess, is drafting legislation to bail out her friends again and I can’t wait to read all the transparency provisions and auditing requirements she is about to impose. You want to bet there are none?

Further Reading

Dallas wins the Bankruptcy Contest

Is our mayor up for some litigation regarding his multi-year efforts to keep the plates spinning? Seems a group with standing…ahem those expected to pay for this fiasco, should pool our resources and file a lawsuit to see who all are responsible and how to hold them accountable.

The mistakes/distortions/lies of the actuarials were identified the very first year as well documented by the initial under funding that continues to this day. Subsequent mayors attempted patches that did little to help. They blamed legislators for their dilemma. The money was not there. Compounding interest didn’t occur. There is no way to make this reality go away.

We the people better take this into our own hands before it gets worse for those that will be impacted.

Allowing any elected official to make a promise today, that will not have to be paid for until long after they have left the scene, is a recipe for disaster.

This issue exists at every level, city, state and federal and not only in Houston or Texas, but everywhere in the country.

We must eliminate their ability to make these promises.

Those pension deposits made from the officers checks are matched by government funds 2 to 1. So the majority of the money in those accounts ie: 60 {997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} comes from public sources. Now take for example the public servant that had over 4 million dollars owed to him by the fund ? Thats a lot of money in addition to the fact that when he retires he will receive a pension of 90{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} of his pay grade at retirement probably around 120K annually. As a private citizen and a business owner I will never see that kind of money not even in 4 lifetimes. lets add to the fact that HPD officers work up to 45 hours a week of extra employment at the rate of 45.00 dollars per hour and you can add 70k annually to their already extravagant salary and they get to use public resources and special exemptions while they do it and all the time the private sector people dont get any of these special emoluments or privileges. HPOU hides these facts. HPOU has a special legislative PAC fund that they pay out to these legislators that enact all of these shady dealings.

Will, your facts are wrong only because you don’t care to do real research on them. Talking to your cousin’s lawn guy’s niece’s teacher isn’t a source. Anything published in an op-ed is trash.

In one of his many op-ed pieces, Bill King made the claim that Houston FFs were making more in retirement from their pensions than their actual salaries while working. So effectively, he claims one was making a 100+{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} pension.

The only way I could manipulate the numbers to make it work was to

1) use an annual pension total

Divided by a salary from 20-30 years prior

(So that’s disingenuous right off the bat)

And

2) Take a speculative DROP amount and amortize over some arbitrary amount of time around 10-15 years.

Then combine those 2 and then you have your fake news headline;

“WOW! Houston Firemen making 130{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} pension! Very Unfair! ”

You don’t math well either. If the city pays a 2 to 1 match into a retirement account, the total balance after 30 years will probably be comprised of something around 60-70{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} earnings and the rest on actual contributions.

What kind of TVM if money calculations have you been running.

I doubt the actuary will lose the case. The numbers provided them were from bonanza years leading up to the Dot.com crash, Houston’s City Council and Mayor Brown then ignoring warnings from the state regarding optimistic projections. Further complicating matters is how city leaders did not bother having their own actuary verify the numbers, this from a Mayor well known for two things: 1) always going on junkets and 2) having a propensity for approving expensive studies. The kind of work actuaries do is based on tinkering with great deals of data and every report includes numerous warnings regarding the dangers of relying too heavily on the resulting projections, the lack of a smoking gun proving the intent to defraud just seems to be a hurdle city quality lawyers are not likely to make stick.

Speaking only for Houston Police pensions, not the fire department or Dallas who both receive more generous benefits, it should be noted that william above is incorrect. Under the plan in effect since 2004, employees pay over 10{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} of their income to achieve a 45{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} pension when they turn 55 years old. They do not have a DROP benefit, nor will they gain one under Mayor Turner’s proposal. This group makes up a majority of the police force and should the proposal pass in Austin as written, it is likely that many under the old plan will retire, following the command staff that are almost all leaving. The latest Houston Chronicle article only addresses officers applying for the Phase Down program that allows them to use time saved up to keep better medical benefits. Out of close to 5000 officers, about 150 applied for that program alone, the majority of people retiring will take the resulting checks for their time so look for closer to 750 to leave, all of them with a 55{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} retirement and none with 4 million dollars.

What william is likely referring to is the Harris County pension offered by constable offices and the Sheriff department where employees pay in 6 or 7{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} each year for the county to match at a rate of 2.25 to 1. Unlike the city officers, the county also pays for Social Security benefits which increases the cost but very few deputies make over 100k a year unless they obtained high rank early on and stayed for 40 years, In neither case do officers make 90{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} pensions and the only time officers make 45 an hour is when they work on New Year’s Eve or Christmas.

The best solution to Houston’s problem is to join the state plan so no under funding of pensions can occur. Dallas might consider that program as well because in both cases, it removes the incentive to chase high investment returns or offer benefits that the cities won’t pay for. Eventually, if enough cities join in, pensions will not be so wildly disparate and officers will be able to move from job to job more freely without losing benefits. I can be reached via my email address if anyone has any additional questions, just trying to clear up a few misconceptions.

Politician promises should often be taken with a grain of salt until they come through on said promises, in my opinion.