School finance in Texas is back for its biennial place under the legislative microscope. The Texas House was the first out of the gate with its plan and here is a look at it from two sides.

First, from my Rep. Dennis Paul (R-129). Rep. Paul sent this over the weekend:

The Texas Plan for School Finance Reform

Earlier this week the Chairman of the House Committee on Public Education, Rep. Dan Huberty, filed House Bill 3, the “Texas Plan” to provide meaningful school finance reform. I am a proud co-author of this legislation to fundamentally transform the public school finance in Texas.

The Texas Plan invests $9 billion above enrollment growth and current law entitlement toward student achievement, teacher quality and property tax reform, and will put more money into Texas classrooms than ever before. It represents the first major rewrite of the state’s public school finance system undertaken without threat of a court order.

You can visit www.TheTexasPlan.com to learn more about the plan. Here is a brief summary:

• Invests in Texas students and teachers by adding approximately $9 billion in funding above enrollment growth and current law entitlement over the next two years

• Empowers local school districts to put more money in their classrooms by raising the Basic Allotment from $5,140 to $6,030, an $890 increase per student

• Provides property tax reform by lowering school property tax rates by 4 cents statewide

• Reduces recapture from $7.7 billion to $4.7 billion for the biennium, a $3 billion or 38% reduction

• Establishes an early reading program that funds full-day, high quality Pre-K for low income students, setting the right foundation for students to be able to read at grade level by third grade

• Substantially raises the minimum teacher salary schedule and allocates an addition

• $140 million in funding for a teacher quality program, providing districts with the resources for recruiting and retaining teachers in the classroom

• Enhances the yield on the “enrichment” pennies, allowing schools to earn and keep more money for property taxes levied above the standard Tier 1 tax rate

• Creates a professional development grant program to train teachers in blended learning instruction so they can effectively combine e-learning and traditional classroom instruction

• Dedicates more money for dual language immersion education, which has proven to be more effective in producing greater achievement levels for multilingual and native English speaking students

• Equips districts with the resources needed to identify and intervene at the earliest signs of student dyslexia and related disorders

• Establishes an extended year program that allows districts to combat “summer slide” by providing 30 days of half-day instruction for students in grades PreK-5 during the summer months

• Updates the transportation funding model from a burdensome linear density model to a simplified one dollar per mile reimbursement

• Allocates resources to low-income students on a sliding scale (rather than an equal weight) to prioritize students with the highest needs, and provides more funding to schools with higher concentrations of economically disadvantaged students and generational poverty

• Quadruples the amount allocated to fast growth districts to build and equip new instructional facilities funding to $100 million per year

• Expands career and technology education programs for students in grades 6-12 (previously grades 9-12), making students more skilled and better prepared for the workforce or post-secondary education

• Establishes a grant program for districts to offer parents of economically disadvantaged students with learning disabilities in grades 3-8 access to additional services to help improve educational performance

Michael Quinn Sullivan included this in his Texas Minute report this morning:

• While Gov. Greg Abbott designated six items as emergencies and therefore eligible for rapid movement, only the Senate took floor action on two of them – and both were focused on creating new spending rather than tax relief or reform.

• There was a great deal of excitement in January when House Bill 2 and Senate Bill 2—the property tax reform measures — were filed with the blessing of Gov. Abbott, Lt. Gov. Dan Patrick, and House Speaker Dennis Bonnen. The Senate’s Committee on Property Tax held a hearing the first week of February, the result of which was an improvement in their bill letting more Texans opt-in to the protections.

• SB 2 hasn’t been heard from since. Amarillo Republican Kel Seliger has expressed outright opposition to reforms protecting taxpayers, and there has been suspicious silence from several other Republican senators.

• Meanwhile, HB 2 finally received a hearing two weeks ago in the Ways and Means Committee. However, the chairman of the committee has yet to call for a vote. There seems to be little urgency for the legislation in the House.

• But that’s just the reform. What about relief? There is apparently a lot of surplus money available, but it appears lawmakers are more interested in spending it than giving it back to taxpayers. Rather than grow government on lefty do-gooder programs, that big pile of money should be given back to the taxpayers.

• Senators moved rapidly to pass a $4 billion teacher pay raise measure. It’s most notable for directing specific dollars into the classroom but contains no systemic reforms. They also passed Gov. Abbott’s $100 million measure creating new mental health programs.

• Speaker Bonnen did speak somewhat disparagingly last week about the Senate’s $4 billion pay raise proposal… as part of advocating for his own even-bigger plan to pump more money into an unreformed public education system.

• The Senate wants to give money directly to the teachers, while the House allocates more dollars to the same educrat administrators who have thus far failed to prioritize classroom spending. But make no mistake, both chambers have put a government spending spree ahead of property tax relief.

• When it comes to substantive property tax relief, neither chamber has yet done much. The Senate has earmarked $2.3 billion in its proposed budget, while the plan promoted by Speaker Bonnen contains $2.7 billion in relief.

• Even one of the House school finance measure’s co-authors, State Rep. Matt Krause (R–Fort Worth), says his chamber’s property tax relief offering is “not substantial.”

• Texans should be asking their state representatives: Why would the House spend so much money without trying for substantial property tax relief?

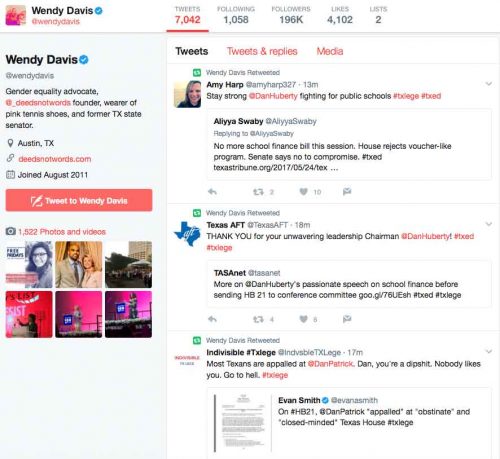

So you have two sides. I’m not well enough versed in the intricacies of school finance to discern the subtleties in each argument but it is important to note that the two sides have completely different backgrounds. On the Texas House side, it is being pushed by Rep. Dan Huberty (R-127), formerly a school board member. And on the taxpayer side, Michael Quinn Sullivan, well known taxpayer rabble-rouser (and I mean that in a good way).

The biggest problem I have with the Texas House school finance plan is the full out marketing assault to get their plan passed. When any organization does that, it doesn’t bode well for taxpayers. I mean really, setting up a one-sided website, TheTexasPlan.com, with no notice of who is paying for it? That should bother any taxpayer. And did you see all the fluff pieces this weekend about Speaker Dennis Bonnen’s challenges with dyslexia and how he really is emotional about our schools? Like those of us without dyslexia aren’t? And what a coincidence that his dyslexia was discovered the day the website was released, right?

Like I said, I don’t have enough knowledge to get into the depths of school finance. But I do have enough experience to know when taxpayers are about to get hosed.