Two of the basic things that a chief financial officer does when taking over an organization is to conduct and audit, to confirm the state of financial condition, and a financial needs analysis, to determine the actual financial demands, current and future, of the organization.

Since I am a candidate for the office of Texas Comptroller I decided a couple of months ago to conduct a financial needs analysis of the state of Texas. I will conduct the audit when I assume office in 2015.

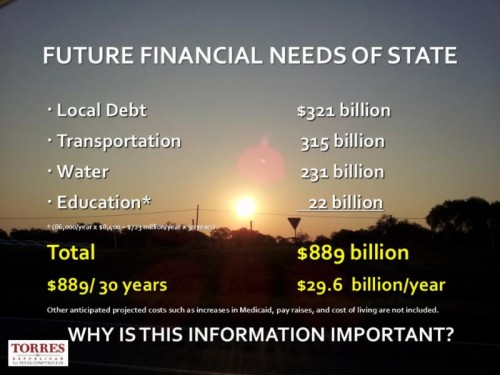

The financial needs analysis revealed some sobering findings. Here are my findings for the state of Texas in the coming 30 years.

FACT #1

In the 83rd Texas budget, SB 1, the two top budget categories were Education at 52.4{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} and Health and Human Services at 30.9{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} for a total 83.3{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} of the total General Revenue budget of $100.5 billion. This leaves only 16.7{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} for all other state agency funding.

FACT #2

The current estimated total State and Local Government Debt is approximately $361 billion. Since many state and local debt bonds are often long term 30 year bonds, this means these bonds must be paid off, principal and interest, within 30 years. Therefore, for purposes of my study I will be using 30 years as the time period for the study.

FACT #3

Based on a 2009 study in order to adequately fund all the projected transportation infrastructure needs for new roads and for maintenance for the next 30+ years the total projected cost is $315 billion.

FACT #4

According to a 2012 Water Plan report in order to adequately provided for the projected additional water supply for a growing business and state population 2013-2060 the total projected waster development costs is $231 billion.

FACT #5

Based on current estimates approximately 86,000 new students enter the Texas public school system each year. The current reimbursement cost for each student is $8,400 per student per year. This means in order to maintain education funding at current levels, Texas must increase education funding $723 million each year for 30 years or a total of $22 billion.

FACT #6

Other anticipated projected costs such as increases in Medicaid, pay raises, education funding and cost of living increases are not included in these projections.

FACT #7

The total costs of future financial needs of the state is minimum of $889 billion or an easy $1 trillion with interest and cost of inflation. Now, let’s have a bit of fun with this. How much is a trillion dollars?

Let me illustrate so please CLICK HERE and notice the picture associated with each month beginning with $100 bill. When you are all the way to the bottom of the page you will be totally amazed.

To view my full presentation of this topic click the link: Texas Tomorrow: The Future of Texas 2014-2030.

WHY IS THIS IMPORTANT?

The business industry has already issued public statements warning the state what would probably happen if the state fails to properly resolve the issues of education, infrastructure, and water. The general consensus is that small businesses and various large industries would pack up and leave the state of Texas. This would be greatly harm the Texas economy and therefore, negatively affect millions of Texas families.

RAUL TORRES POSES A QUESTION

As you can see the financial need is real, but where is the Texas Legislature going to obtain the projected $29.6 billion per year in order for the state to fund these projected costs in an adequate manner? Here are the most obvious solutions. If it were up to you which option would you choose?

- Higher taxes

- Higher fees

- Reduce state provided services

- Other

CAMPAIGN SILENCE

The sad truth is that none of the statewide candidates are addressing these very critical long term financial needs in their campaign speeches or material. Could it be they don’t know about it? Or perhaps it’s too toxic for them to deal with such an issue? Or perhaps they just don’t have a reasonable, common sense answer on how to best resolve this looming financial crisis?

SOLUTION

Well, I believe that my Texas Tomorrow economic plan is the answer to solving all of thes critical financial issues. In my book, Texas Tomorrow: An Economic Plan for Texas in the 21st Century, I lay out my recommendations for both financial and legislative action that Texas government should implement to generate the $15-$20 billion per year in revenues to fund these projects, but also my plan includes a significant increase in new Texas jobs, calls for a reduction of taxes, the elimination of costly regulations, pump an additional $6-$10 billion into our state economy. This is actually what we need to fund the financial needs of growing state like Texas. All of this can be accomplished without raising taxes or fees.

CONCLUSION

No other Comptroller candidate or statewide candidate has any type of plan to address these very critical financial needs, yet they all believe they are the most qualified and want to be your state’s next Comptroller. Does that make sense to you? If you love your children and grandchildren you must vote for the candidate that knows how to handle these issues without raising taxes or fees.

As you can see experience, training, and the right knowledge does matter in the race for Texas Comptroller.

It is for this reason I humbly ask for your vote and financial support. Sign up at http://www.electraultorres.com. To help us continue our statewide momentum, please consider making a small donation of $5, $10, $25, or $50 today!

I hope this report has been useful. Since Austin politicians don’t want to tell you all of the truth, I will because you deserve to be told “the rest of the story.”

For Texas and Liberty,

Raul Torres, CPA

Mr. Torres: I am pleased to see you have performed a stress test on the future of the state’s finances. Did you calculate the compound rate than state taxes would have to increase to meet its obligations? There is a small group of CPAs here in Houston that are making similar disclosures about the City of Houston’s finances. One member, Bill Frazer CPA, new to politics, recently ran for City Controller and barely lost to the four year incumbent. Glad to see you in the race. Don Sumners CPA (former Harris County Treasurer and Tax Assessor-Collector. 713-857-0236, [email protected]

Don, I did not calculate the compound rate simply because my goal was to keep this issue as simply as possible for the people to digest. As you can see the figure is mind blogging for most Texans. But, you do bring up a very important financial element that should be factored in when government puts out financial data to the public. As we all know, almost in every instance. when government announces a financial amount, we can pretty much bet that the true figure is in reality significantly more than the amount they make public. As you know Don,being a CPA, there are lots of ways for government to hide (non disclose) actual costs when they wish to do so. We definitely need much more transparency in government. This will be one of my goals as Comptroller, either with a carrot or a stick, but we must get other government agencies to tell the public the truth regarding their finances. By the way I meet Mr. Frazer and I supported him completely. Unfortunately, as we all know the best, most qualified candidate doesn’t often win because of the whims of the political machine or the process. I hope Houston hasn’t seen the last of Bill Frazer. We need many more folks like him in key government positions.

While I disagree with a number of your comments, particularly in the book, at least you are discussing matters of substance. I think the reason most businesses locate here, our lower taxes, lack of income tax, and relatively light regulations, will keep them here no matter what happens to our infrastructure or education. I also think there is no consensus among businesses in general regarding such topics but I’d like to see better examples of reducing specific regulations for substantial cost savings that do not leave us open for worse consequences. The belief that the Texas legislature or our representatives in Congress are going to sway federal agencies in any meaningful manner flies in the face of historical observation just as pushing more costs on residents over businesses directly contradicts what most voters want.