The City of Houston gotsta get paid. For years, city leaders have operated with the philosophy of spending money that the city just doesn’t have. The Turner administration is no different.

Under Mayor Annise Parker, the media looked far and wide for a way to blame Republicans for the sins of liberal spending by a series of Houston mayors. Last legislative session, Mayor Parker took the position that Republicans refused to give her local control over the City of Houston pensions. Conversely, Parker promised the Houston Police Officers’ Union (HPOU) that she would not seek local control or use the city’s sizable lobbying forces to seek local control. Although Turner’s legislative strategy is a little more sophisticated and he is certainly more eloquent, he shares the same objective as Parker – keep on spending money and kick the can down the road.

Last session, State Representative Jim Murphy offered a bill for local control, which never made it out of committee. This was always the plan. Mayor Parker had to fool people for her last two years in office in order to keep spending money the city did not have in their accounts.

Mayor Turner’s dilemma is different because he was just elected to a four year term with a potential second term in his sights. After many years of working to assist city leaders in the legislature, Turner knew that his sneaky bastard plan had to be far more creative than Parker’s 2015 plan. Turner’s plan is simple: involve all three unions (police, fire, city employees), lobbyists, patsy legislators, and the Lieutenant Governor in the ultimate goal of spending money that the city doesn’t have in the coffers. I will count lining the pockets of lobbyists as a goal for discussion purposes.

Mayor Turner’s dilemma is different because he was just elected to a four year term with a potential second term in his sights. After many years of working to assist city leaders in the legislature, Turner knew that his sneaky bastard plan had to be far more creative than Parker’s 2015 plan. Turner’s plan is simple: involve all three unions (police, fire, city employees), lobbyists, patsy legislators, and the Lieutenant Governor in the ultimate goal of spending money that the city doesn’t have in the coffers. I will count lining the pockets of lobbyists as a goal for discussion purposes.

Bill King has done yeoman’s work in holding Turner’s feet to the fire for a real solution to the pension problem. King ran on a platform of meaningful pension reform with the solution of moving all new employees to a defined contribution plan. Turner was endorsed by all three unions after he promised to oppose King’s defined contribution plan.

The three unions strongly oppose defined contributions because defined benefit plans are easily manipulated by politicians to benefit the unions. Defined contribution plans remove the politics from the equation. Thankfully and in the face of unfair criticism, King has remained engaged at the legislature in the defined contribution cause. March madness is in full effect and the Houston bracket of bad guy liberal spending is winning the tournament.

Turner knew that he had to employ a kick the can down the road strategy without being obvious. Turner’s first feat was to get Lieutenant Governor Dan Patrick and Senator Joan Huffman to agree with HPOU officials to take defined contribution off the table this legislative session. Ray Hunt, HPOU President, is a smart guy and is always covering bases. I like Ray even though I disagree with him all the time. He is a nice guy who does a very good job for his officers. They are lucky to have him.

Turner also lucked out when Patrick gave Huffman the position of chairwoman of the Senate State Affairs Committee where she is tasked with getting Turner’s bill through the senate.

Word started leaking out last summer that Turner’s scheme would employ a cap on city pension payments. So, the next time you hear Turner say he does not like caps – a la the property tax cap – remind the mayor that he is supporting his own version of a cap on city pension expenses, albeit a fake one. Beginning last summer, policy wonks immediately began speculating how Turner’s cap would work and whether it would it be enforceable. Turner was smart enough to call his cap a “corridor” – but, it is really a cap. Turner doublespeak.

State representative Dan Flynn chairs the House Pension Committee. Flynn’s bill, all 246 pages, has been circulated in the business community in order to garner the support of downtown types who are beholden to the mayor for handouts. Thankfully, King and members of the Arnold Foundation began analyzing the bill and sought edits that would tighten up the language. The devil is always in the details. King, Arnold Foundation representatives, and business leaders met with Senator Huffman in order to make crucial and necessary changes to Flynn’s bill. King and his crew spent hundreds of hours analyzing and tightening the corridor/cap language. The goal of these edits is to force the unions to adhere to Turner’s supposed principals. Anything else bankrupts the city.

Needless to say, after all the hours spent by King and others to tighten up the language, Huffman’s substitute filed on Monday is an exact copy of Flynn’s bill. None of the recommendations by King, the Arnold Foundation, and the local business community made it into Huffman’s bill. The good guys were played – Huffman was the secret agent.

Huffman had probably been informing Turner and his lobby team of King and the gang’s recommendations all along. It should be noted that Huffman and her husband are longtime friends with Ray Hunt and Mark Clark, HPOU’s top lobbyist.

King has vowed to spend his time next year running against Huffman. King does live in her district and I believe that he is seriously considering the possibility. I will support him for his attempt to do the right thing on this issue alone. We will need to work with him on some other conservative issues but don’t forget that Trump came along too.

On Monday, I was present in the Senate chamber and testified on Senator Bettencourt’s SB 151 that was heard immediately prior to the Huffman pension bill. SB 151 requires a vote on the billion dollar pension bond by city voters. Huffman’s bill did contain this language but I suspect it will be stripped out in conference. Huffman has proven that she is not to be trusted.

On Monday, I was present in the Senate chamber and testified on Senator Bettencourt’s SB 151 that was heard immediately prior to the Huffman pension bill. SB 151 requires a vote on the billion dollar pension bond by city voters. Huffman’s bill did contain this language but I suspect it will be stripped out in conference. Huffman has proven that she is not to be trusted.

Robert Miller, lead lobbyist for the city and law partner of Senator Whitmire, has covered his bases. Miller knows that Turner’s goal is a sleight of hand – appear as though he is doing something without actually doing anything. This was also true for Parker.

The goal is to keep spending money and lining the pockets of cronies. This fraud cannot happen if the bill actually worked because the unions would have to abide by paying their fair share. It was never the intention of Mayor Parker, Turner, Miller, or anyone in Austin to have this pension bill work as advertised. The goal was to grab the billion dollars and hand it over to the police and municipal employee unions so their retiring officers can make a fast break with their multimillion dollar pensions. Did you know that city taxpayers are making millionaires out of city workers? You know now.

Notice that I did not mention anything about the firefighters. The firefighters are actually the fiscally responsible adults in the room. Although their pension is far from perfect, it is financially much better off than the other two pensions. The billion dollar pension obligation bonds (POBs) proposed in Turner’s bill go to police and the municipal employees union. The firefighters get none of it.

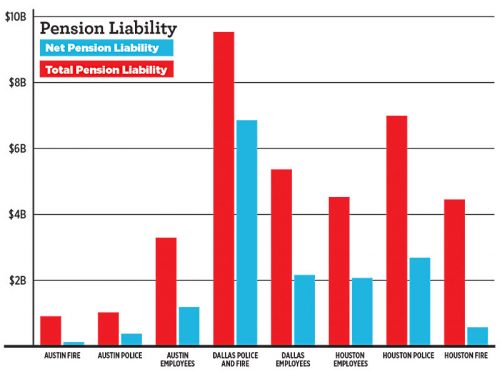

The story gets worse for the firefighters because their pension is almost fully funded; but, they are being treated like the bad guys by city leaders. The city is asking for large concessions from the firefighters who are being punished for being good stewards of their funds. I say this because the firefighters always stood their ground and made the city fully fund their pension. The other two pensions did not and allowed a succession of Houston mayors to rack up a ten billion dollar unfunded liability.

Basically, the other two pensions have turned a blind eye to the out of control spending at the City and have taken lots of IOUs. Turner’s goal in all of this is to keep spending money that the city simply does not have. Turner’s pension plan is bogus and falls far short of his claims. Even worse, we really do not know the real fiscal health of the private equity investments held by the unions. The billion dollar pension bond could just be a starting point for the taxpayers. We need an audit by qualified, competent auditors who can be held responsible for erroneous financial information of both funds.

Either way, all of the actors in this year’s legislative tournament are behaving badly. Both Dan Patrick and Joe Straus have lined their pockets with union money. Do not think for a second that Joan Huffman acted without Pappy O’Patrick’s approval. Governor Abbott’s campaign has taken lots of money from unions; so, don’t expect him to do the right thing for Houston taxpayers.

Now is the time to fill out your bracket. My money is on the taxpayers losing bigly. The bottom line is that March madness has nothing on the drama at Texas Capitol. The next big game is Monday when Flynn’s bill is heard in the House.

It is true that most private-sector pension plans are defined-contribution plans. However those are supplemental to Social Security, a defined benefit plan. Police and fire fighters do not pay into Social Security; their city pensions ARE their social security. Making them take the risks of highs and lows in the securities market is more than in required of private-sector workers.

The best point in the article is that the fire fighters’ pension made the city keep up their payments. So far from the other unions manipulating the politicians, they let city council get by with under-funding pensions. Those, by the way, are the “locally controlled” pensions; fire fighters pensions, under state control are the only ones adequately funded. City workers have a contract; neither they nor their unions deserve blame for the fiscal sleight of hand of successive city councils and mayors.

Hmmmmm. . . . .

So, Social Security is a defined benefits plan. And, hey, what do you know, It’s in the same kind of fiscal decrepitude as Houston’s pension plans. The moral of this story is: if you trust politicians with your money – they will screw you to the wall – if you’re lucky you’ll get a kiss afterward.

And, frankly, while you claim that the unions bear no blame, the reality is that the union leaders have known for years that this was happening, they simply made the decision to play the political game with their politician buddies rather than stand up for the rank and file they represent.

Here’s the problem in a nut shell. Nobody was willing to stand up and tell the public the truth: the politicians they elected to keep the public trust are (and have been) thieves. They have stolen our future and our children future all in the name of dishing out bread and circuses in hopes of being re-elected. It’s happened on a local, state and federal level and it’s not gonna stop until we kick the bastards out.

BTW – I had high hopes for Dan Patrick when he first went to Austin – but he’s turned into just another scheming politician. And, I fear Paul Bettencourt isn’t far behind.

Richard Boyd,

I get what you’re saying with the nut shell comment, to a degree. It is the case that both police and muni have negotiated pay raises in lieu of benefit enhancements since around 2004 or so. The city’s position was that they could not afford current pay raises UNLESS they had some flexibility with contributing the ARC every year to those two retirement systems. So, those pensions stepped away from the state control requirements for the city to fund its ARC 100{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} every year without fail.

The firefighters at the time had enough common sense to realize that

1) dropping the bare minimum contribution, if left to someone holding political office, will guarantee just that – the bare minimum

2) doing that only makes for a situation for snowballing liabilities with the opportunity cost of missing out on the returns that should have been generated those years of “pension holidays”

So as a result, HPD officers, despite being way below the market rate of Texas LEO compensation, are paid WAY more than HFD firefighters. If I go to hpdcareer.com and “build my salary” – ignoring the fact that I have been promoted in HFD, but inputing in education, language skills, etc. I would receive a 31{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} pay raise going to HPD! This is of course assuming I was still just a police officer and never having promoted.

Despite this huge discrepancy in pay, I don’t bemoan the cops. What I do bemoan is this pension “solution” which effectively punishes HFD personnel for taking crap wages for decades in the form of large benefit cuts, takes out a $1b bond, and then gives 75{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} of it to police since their salaries were inflated by the city shirking its responsibilities for many years.

Also, another point, I see this everywhere in the public pension debate. The union does NOT negotiate retirement benefits with the city. They are two separate entities, who at times, have conflicting interests.

I was not aware Robert Miller was a law partner of Senator Whitmire. With that law firm receiving money from both the firefighter’s union and the city, what could possibly go wrong?

Gentlemen,

the last time we all conversed on this subject some two weeks ago, one of the firemen representatives was offering to correct my misunderstandings if I would only privately write him. My counter suggestion was that he enlighten all of us by responding on this blog so we’d all benefit from his insider knowledge. To date, and as predicted, he has vanished.

This latest piece seems more convoluted than Mr. Hooper’s previous efforts, his focus from the political maneuvering to showing the problems with local control to the amounts some Houston city employees are making, only a few highlights. As a policy question, I reiterate my previous stance of pointing out that few living outside the city should care at all, the politicians, employees, and voters have had ample notice on every topic yet made their choices. Today’s Houston Chronicle even goes into detail about city leaders willing to spend over $500 million for hundreds of miles of additional bike trails, one councilman reminding us how any such project will almost certainly cost a great deal more.

It doesn’t matter to me that the firemen will continue to churn out millionaires, their lack of previous cuts and lost political cover from deceased Senator Mario Gallegos well known. Nor does it matter that the other two funds lacked the ability to force the city to pay enough into their coffers, the three pension systems combined are all in the red and benefits too expensive, as Don points out. The policy dilemma is clear, should the state legislature give the city control over their own finances given the history or should valuable time be spent babysitting the flawed elected leaders as they wheel and deal the city into bankruptcy?

Why should state representatives in West Texas care what the city of Houston does? How about those from the Panhandle, East Texas, or the Valley? As the state is not responsible for any shortcomings of their finances, just give them local control to abuse as they see fit. It might be prudent for the state to demand full funding of any municipal pension in a one-size-fits-all bill, even extending it to the state plans that are underwater at this writing, but it defies common sense to claim no one saw this coming.

By the time mayor Turner is out of office, it will be immediately evident just how well his plan will fare, though probably sooner than that, and if it falls as flat as we think it will, the voters can make better choices than they have for the last 20 years. If by some miracle the plan works, good for them, but subjecting the entire state to keep having to rearrange the chairs on the Titanic known as the city of Houston, seems wasteful.

Best Regards, Olivia

Please see below. Thanks.

Olivia, I presume you’re not referring to me as the firefighter who vanished in the last thread of Houston pensions. You never replied on said thread.

Dear Mr. Rhem,

you are mistaken. I replied on March 11 and as I recall, my reply was the last one made in the thread, remaining on the top of the recent comments box for days afterward.

Sincerely, Olivia

I’m not sure to what you’re referring. The thread I have in mind is this one: https://bigjolly.com/senator-joan-huffman-let-the-people-vote/#comments

The last comment entry was from me on March 10. Are you speaking of a different thread?

Thanks.

Did you see the above Ms. Parsons ?

Dear Mr. Rhem,

the thread I was speaking of was this one, https://bigjolly.com/letter-houston-firefighters-relief-retirement-fund-members , the threads running concurrently from what I can tell given the dates and times. Unlike the thread you mentioned, the one I brought up remained at the top of the recent comments section for days.

Having followed the responses, I posted some notes from one of my associates in the latest thread on pensions. He outlined a few of the problems with the reasoning coming from the employee contingent and I have yet to see a rebuttal. As soon as Don, myself, or one of those concerned about costs writes something of merit, you or one of the others thinking the city has unlimited finances either changes the subject or throws in erroneous information. Then there is the continual comparison between police and firemen but nothing of substance showing how the two jobs are being compared. If I were to compare a systems analyst with a project manager position, I’d be raked over the coals by Human Resources for the apples to oranges nature of the comparison yet you want us to believe these are generic jobs? Go to the other recent thread and answer the questions as you like but to date, you haven’t been convincing.

Sincerely, Olivia

No need to be nasty. It can take all forms, but I don’t think you should resort to being passive aggressive.

Don’t imply I have no concern for costs. I own a house in the city limits with no homestead exemption, and thus pay taxes almost double the near carbon copy house across the street. I should probably get an extra vote in local elections at the least.

The comparison between police and fire has been settled many times over in many municipalities. For being different professions they couldn’t be more similar. Education requirements, dangers, work hours, etc. Really the biggest divergence would be the fact that firefighters have worse health outcomes than police as it comes to exposures to toxic substances and the associated long term effects.

HPD and HFD had pay parity till Lee Brown, a former chief of HPD, became mayor. In fact, pension funding really became a problem with the police when Mayor Lee Brown was able to change (pay attention to this!) their base pension formula to whatever percentage X…..your 1 highest check. Wow. The appointed chiefs and friends of him did particularly well.

Now, you don’t like the fact that we use a formula that uses 78 pay checks (and honestly, since I try to bridge the gaps here – I can get behind changing this). HFD was the adult in the room in that instance and said, that’s reckless and not sustainable. Well, for that HPD is going to be punished with a 30-40{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} pay raise over the last decade and 3/4 of a $1B bond.

Like ole Will Shakespeare said, “misery acquaints a man with strange bedfellows” or as we’d say today, politics does that. Check out Mr. King’s post from Wednesday along with some excerpts:

The effect on the three plans is different. Firefighters will be the most penalized. The payroll for the fire department is roughly $300 million. The firefighter pension fund has about $3.7 billion in assets. If it misses the assumed rate by one percent (6{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} vs. 7{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986}), that is $37 million that would have to be made up by an increase in employee contributions. That means that the firefighters’ contributions would have to increase by 12.2{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} ($37 million/$300 million payroll). The firefighters are already contributing about 10{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} toward their retirement, so this would take the required employee contribution to 22.2{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986}.

and

One of the perverse outcomes of the corridor is that the better funded the plan, the harder the members of that plan are hit.

http://billkingblog.net/2017/03/29/employees-likely-to-face-massive-pension-contribution-increases-under-turner-plan/

Dear Mr. Rhem,

Upon closer examination, you are making my case for me. Here are a few thoughts based on your latest comments, none of which address the very real fiscal issues raised last weekend that I posted.

1. You claim similarity with the city police, as some kind of shield against cuts, forgetting that they took large cuts of this sort 13 years ago and are poised to do so again. More than half their employees are under their newer plan that completely lacks a deferred retirement option, prevents them from a pension until they are at least 55 years old, doesn’t include overtime, and so forth. How many of them have the same work schedule you do, of 24 hour shifts? In educational requirements, HFD requires 24 hours of college while HPD demands 48 hours, preference for more than that leading to over half having 4 year and graduate degrees. The list goes on and that doesn’t even touch job responsibilities differing for each profession. But all of that is a side issue since you are both in the same boat facing large cuts to restore city finances and you even admit that they are underpaid too.

2. Under your existing pension plan, your benefits are based in large part on being able to obtain an 8.5{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} net return on assets each year. With all due credit to Mr. King for his latest calculations, it should be noted that your own pension board admitted your ten year average return is 7.5{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986}. Your pension report points out that dropping the rate one percent will increase the liabilities over $1.35 billion dollars. Under state law, the city is responsible for paying in what is needed, only a 5 year smoothing provision keeping Houstonians from kicking your benefits to the curb considering last year’s loss of almost 1.5{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} and the year before obtaining only 1.29{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} in 2015.

3. If you are going to write supportive comments about Bill’s columns, you should understand that he is calling for all future benefits to be tied to a defined contribution pension, the type of plan your pension board and the mayor agree would result in the heaven’s falling from the sky. Most of the regulars on this website agree with Bill in believing the very minimum pension change should be for all new employees to be placed under a defined contribution system before cuts are made to existing employees. That type of pension places all the risk on the employee instead of the employer, your own fund’s returns showing why taxpayers expect that change as a starting point, not the sole cut. Where do you think the 2016 pension loss of yours should come from, the nearly $400 million, or the relative loss of 2015?

I’m not sure how I am making your case for you. I’m not really sure if you laid out your case really. I have sought to do a few things with your posts:

correct mistakes (not everything you have said is wrong, but there are mistakes)

more often add facts to your facts to give an accurate picture

(EG “You lost 1.2{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} one year and only made 1{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} another year!” Yes, and made 17{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} and 11{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} the years prior. I presume it’s not an accident that was left out.

Support any impressions you have that I agree with

Now, to your points:

1) HPD gutted their pension, you’re right. What occurred though was not from a heart of magnanimity. Those currently working for HPD, but still operating on the “old” pension agreement have an endless DROP. Literally. They also negotiated hefty pay raises. Effectively they endorsed the city’s irresponsible desire to defer necessary, legally obligated expenditures to fund other various pet projects. The city wanted to have its cake and eat it too. You won’t find many “old head” cops disputing this. They funded (at the time) current, substantial pay raises, kept their generous pension scheme, and did so all by reducing the total compensation of all future HPD officers.

I’m not sure what your point is about 24 hour shifts. Many FDs are transitioning to 48 hour shifts. My wife works 24-30 hour shifts as a physician. No one wants to spend nights away from his/her family. City’s prefer the structure as the amount of transitions between shifts increases, so does the potential for overtime.

The difference between police and fire is that FDs have minimum staffing ( I feel like I discussed this before). If a FF calls in sick before coming to work, the FF who should be going home at the end of his/her 24 hour shift is required to stay and starts collecting OT starting at 630a. In contrast, if a police officer calls in sick, no one fills that position. You just have 1 less patrol officer in your neighborhood. I’m sure PD has some minimum number of personnel on duty at any one time, but they regularly surpass it. The fire department just staffs with the minimum.

I had a senior patrol officer at our station the other day helping us with custody issues on some children abandoned at the station. He had almost 50 current, outstanding 911 calls in his area. What does this mean? HPD is vastly understaffed. There was literally a queue of almost 50 people who had called 911, and it was up to him to triage those calls in a sense.

I’m going to be very conservative here, but the last time the city hired a consultant to examine the PD for inefficienies and make recommendations, they insisted the city needed to hire more than 1,000 officers (I think this number is bigger, but I’ll stick with that number).

Similarly, at the beginning of Mr. Turner’s administration, a consultant hired by the Parker administration, finally produced a study on the FD. It said we were a few station short of the industry standards, possibly a few fire companies, and the big kicker….close to 25 ambulances. To staff and purchase a BLS ambulance 24/7, 365 is around $800k.

I imagine if we didn’t spend $500m on bike trails we could manage to fund a fraction of those recommendations…

When I was hired by HFD, the requirement was a DD214 with honorable discharge OR 60 college hours. It has now been changed to 15 hours on the latest civil service exam. Why is that ? Because Houston is having difficulty recruiting. What does that mean? It means people will not come work here for what the city is offering. There is a reason other city’s in Texas hire a small percentage of there applicants (think single digit percentages), and why Houston hires 40{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} or more of applicants.

Similarly, the physical standard of running 1.5 miles in 10:30 has dropped to 15 minutes (so a walking pace), and upper body strength requirement of 6 pullups to 0. The old adage of “beggars can’t be choosers” applies here.

2) I agree that 8.5{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} is too high. Our pension board has discussed dropping this for the last several years, and funding that more conservative, more reasonable discount with cutting benefits (chiefly the COLA). They have designed a net neutral means of dropping the discount rate.

The 5 year smoothing process is not a gimmick. It’s only common sense. It would be entirely asinine to infuse into a fund 100{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} of the capital needed to bring it back to 100{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} after a poor return in a year. If you lost 20{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} of $500k in 2008/09, would you write a check for $100k into your brokerage account ? Could you?

3) I am very well aware of Bill King’s position. Just because I reference a truth that he recognizes doesn’t mean I endorse his entire solution. If I quoted you saying, “2+2=4” I doubt you would accuse me of endorsing your solution.

Olivia, Jonathan Cassidy did an excellent job of covering the financial aspects of the bill. I tried to cover the political. This is difficult subject matter to those not directly involved. I have always written about the political side. However, I do consult with my colleagues about all of it. Please take time to read Mr. Cassidy’s piece. Honesty is the goal. The more information out their including who is making what helps in that decision making process. I have seen million dollar retirements with police, not with fire.

http://watchdog.org/291481/houston-pension-turner/

Dear Don,

please do not take my comments as criticism, my intention only to point out the difficulty of addressing such a vast topic coherently in a short-form blog. I profess no specific expertise on the matter yet have availed myself of those writing on the topic, primarily those with a proven track record in line with my own way of thinking rather than the liberal slant we see so often in mass media. I also have access to highly educated financial analysts that assure me the present value of a Houston fireman’s pension exceeds a million dollars, Mr. King and others pointing this out as well.

I tasked one of the senior analysts with proving this to me using public data and his report was convincing enough to me. To sum it up, using salary data from the city’s website, the Texas Tribune’s analysis, and the firemen’s pension fund reports, the present value of a retiree’s benefits exceeds a million dollars, often by a vast amount. An fireman remaining for 30 years or more, obtains an 80{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} pension based on their best 36 paychecks. This includes all overtime, supervisor pay when working for a supervisor taking the day off, and a multitude of other factors used to increase their pay. In addition to that monthly pension is a lump sum deferred amount that itself often exceeds a million dollars, 13 years of compiling would be pension checks plus interest. He pointed out that his estimate’s were very conservative, the Tribune numbers reflecting only base pay and not actual checks as well as the need to spike only 36 pay checks over an entire career.

This supports Mr. Cassidy’s piece you so kindly provided as well as Mr. King’s own columns. This was not intended to be a definitive analysis, just a rough estimate to lend some understanding by a coworker as a mental exercise. As you say, “The more information out their including who is making what helps in that decision making process.”, What concerns me is that many of our legislators with otherwise solid conservative credentials have been unwilling to spend a few minutes and ask the right questions. The campaign donations handed them by unions appear small compared to others seeking influence and it seems inappropriate that the people who will have to pay for these benefits do not get to vote on them or their costs.

Warmest Regards, Olivia

Olivia,

I have been referring to the DROP accounts on the million dollar payouts. I was not clear and that was my fault.

From you: An fireman remaining for 30 years or more, obtains an 80{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} pension based on their best 36 paychecks. This includes all overtime, supervisor pay when working for a supervisor taking the day off, and a multitude of other factors used to increase their pay. In addition to that monthly pension is a lump sum deferred amount that itself often exceeds a million dollars, 13 years of compiling would be pension checks plus interest.

This is incorrect, Ms. Parsons. An HFD fireman working 30 years would obtain an 80{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} pension based on 78 paychecks. The equation to arrive at this is 50{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} after 20 years (just like my military family), and then ad additional 3{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} per year after 20. This caps at 80{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986}.

Now, there is the DROP (Deferred Retirement Option Program – created at the city’s request mind you to retain employees). This is what you’re referring to as the lump sum. Currently this is available for up to 13 years AFTER one reaches 20 years. However, by electing to enter DROP you freeze your pension rate.

E.G. work 20 years, enter DROP (pension is now frozen at 50{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} AND importantly based off those 78 paychecks. These are not inflated to maintaining one’s purchasing power once they do actually take retirement.) The employee’s contributions (currently 9{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986}) are credited to his/her notional DROP account along with the city’s contribution (this # varies with whatever the ARC is that year – usually 18+{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986}). These accounts are credited at least 5{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} annually.

At year 10-13 of DROP participation, the account growth slows down. I can’t recall if the employee or the employer contribution is no longer credited to said account. However, both the employee and employer do make said contributions, they are just simply put into the general pension fund.

TLDR: A fireman can get an 80{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} after 30 years OR a much smaller pension with a lump sum but not both of them.

Mr. Rhem,

even taking you at your word, are you aware of the present value of a 30 or 35 year Houston pension, lump sum or not? As it continues after your death at full rate, it exceeds the stated amount. Then the comparisons you and your fellow employees continue to use, either comparing to cherry picked cities or to compare to completely different lines of work, only side steps the reality that your city cannot afford you at current compensation rates. These false comparisons overlook how many area firemen are volunteers that work for free or how most firemen in the state work for considerably less than Houston compensates.

But thank you for agreeing with me that your pensions are comprised of cherry picked checks rather than your entire careers like most people. If some of the specifics are wrong, the overwhelming truth is that years of underfunding have allowed the city to accumulate a great deal of debt without the means to pay it off. The belief that you were somehow insulated from such problems is part of the problem itself, and correct me if I’m mistaken again but how many hundreds of millions of new liability did your pension accumulate in the last two years when your investments fell short of the mark? Defined benefit plans allow for such massive accumulation of debt whereas defined contribution plans do not so at least be honest how quickly things can change under your current system.

Your city of employment is unable or unwilling to continue the current plan unamended . It’s time for your employer to make corrections and be given the tools to forge ahead without involving the rest of the state. As Mr. Hooper has pointed out, without major changes, you will all be in front of a federally appointed bankruptcy judge within a few years, previous cuts by your fellow employees not enough to address the problem. If you think that judge will be swayed by finger pointing or accusations from years prior, or even informal salary surveys from cities out of state or the area, you might want to save a little on the side for handkerchiefs.

Sincerely, Olivia

I think you misunderstand the concept of a “market rate.” It is simply a composite of compensations available to labor under some given constraint. I usually use other large cities in Texas i.e. Austin, San Antonio, Dallas, Ft. Worth. I would hardly call that cherry picking.

At a negotiation with the CoH, back when AP was mayor , and Mr. Feldman was the city attorney (2nd highest paid city attorney in the entire USA mind you and 2nd highest paid municipal employee in the state of Texas), there was a discussion between L341 and the city about establishing the sampling cities salaries.

L341 contended Houston is the 4th, nearly 3rd largest city and should be compared to its peer cities – Chicago, Philadelphia, Phoenix, etc. The city pointed out the obvious that the cost of living varied greatly between us and them. L341 agreed and suggested using BLS statistics about said cost of living variances to control for said differences. After a cursory glance, the city team realized that despite this deflationary device, the CoH would still show to be underpaying. Mr. Feldman then suggested that the city of Conroe was comparable to the city of Houston.

I could barely control my urge to laugh. I know that there are many engine companies in Houston that make more runs than the entire 6 station Conroe Fire Department combined.

Well, needless to say, you have to be comfortable with suspending reality to condone that line of thinking.

The value of a pension would obviously change with what sort of model you use. A annuity probably is the most appropriate, even though you point out that the pension payment still continues after the pensioners death (till any dependents reach 18 or the spouse denies) because the spouse isn’t living 20 years after the pensioner dies typically, and any residual benefits stay with the pension system. I.E. the adult children get nothing

This is probably too high of a benefit estimate, but a $5k monthly pension for a firefighter would be worth approximately $750k. That’s really not that much.

If i go on any host of retirement calculators assuming i stick to a typical 401k with a typical employee+employer contribution, if I input some of my basic data and assumptions 65K salary, work from 22 to 58, save 15{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986}, 7{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} returns, 3{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} inflation – the value of said porfolio is almost $1.8m.

Mr. Hooper: The three unions strongly oppose defined contributions because defined benefit plans are easily manipulated by politicians to benefit the unions. Defined contribution plans remove the politics from the equation.

You will undoubtedbly have a defined benefit plan when you retire – Social Security. Indeed, firefighters will be subsidizing everyone on SS. As many have pointed out (as if it’s a sin) that firemen often work 2 and 3 jobs. As such they pay SS taxes on the other job. However, due to the Windfall Elimination Provision and the Government Pension offset, any social security monthly benefit earned by said firefighter for his side job will be reduced. The amount varies according to two tables produced by the IRS, but depending on your financial situation, firefighters (and anyone else who this applies to) should expect a 40-70{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} reduction in their social security benefits.

As well, our defined benefit plans pay for spousal benefits, line of duty death benefits, and disability benefits. I think your camp is best exemplified by Mr. Quintero at TPPF. During a TexPERS forum on DB plans vs. DC plans, it was pointed out that DC plans don’t offer any the above disability benefits and what not, Quintero replied, “if they are disabled, we are sure they can find a charitable organization that can help.” I suppose Bill Dowling and family, if TPPF, Bill King, etc. were to have there way, would simply seek out charity.

Jack,

You need to re-read the story I wrote. I praised the FF plight. I am for everyone laying the cards on the table and letting the folks that have to pay the bills decide. If Houston tax payers want to continue with DB plans so be it. I do want to be able to drive down the roads. We live in a City, not a pension obligation. Surely, FF can move on and get these types of benefits anywhere. Do not sell yourselves short. There must be a 1000 places you can find these salaries and benefits. My suggestion would not be to look at any of the volunteer fire departments who do your job for free.

Don, volunteers don’t do what I do for free. I volunteered at a total of 3 fire departments before a full time job at Houston (Southside Place, Community (unincorporated Alief area) and Westlake (Austin area). The first two would take any warm body.

In fact, most volunteer departments rely on “duty crews” of professional firefighters, on their off days, to staff the rigs during the day. Most VFDs skew statistics egregiously to attempt to meet industry standards (and still don’t come close to touching said standards).

For example, a professional firefighter friend of mine in the Greater Houston area (not Houston FD), talks about how they have automatic mutual aid with a nearby VFD. The VFD distributes suburbans to a plethora of Battalion Chiefs whereby, by sheer volume, someone is bound to be in the general area.

A house fire gets dispatched, the one guy (chief) alone in his vehicle makes it to the address within 5 minutes. The VFD then reports that they had a 5 minute response time. The paid professional firefighter friend of mine gets there approximately 4-6 additional minutes later. In that span of time, the single fire chief with no equipment or manpower watches the house burn. Then the paid crew, puts the fire out as the volunteers (through no fault of their own, they do have jobs and other obligations) show up to overhaul the extinguished fire.

This is the model for VFDs without day crews in the Houston area. The fact is the volunteer fire service is dying. No one disputes this.

I pick up fine on the smug sarcasm dropped around here. The card up the sleeve of a municipality is they artificially constrain the market by hiring those only under the age of 36. TGLC 143 requires this.

You’re also presenting a false dichotomy. It’s not either employees get DB plans OR I get good roads. Last I checked, the city of Houston paid about $94m into the fire pension for 2016 out of a total budget of $5b. That’s about 1.9{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986}.

I guess you’d make $100k in a year, decide with your wife you can’t tribute $1900 to your IRA that year because you want a better car and a $5k trip to Europe.

Let’s bid it out.

I was expecting more.

Jack Rheem declared: “You’re also presenting a false dichotomy. It’s not either employees get DB plans OR I get good roads. Last I checked, the city of Houston paid about $94m into the fire pension for 2016 out of a total budget of $5b. That’s about 1.9{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986}.”

The continued use of the city’s total budget versus the operating budget your compensation comes from does not further the conversation. Employees are paid and their pensions are tied strictly to the operating budget which is closer to $2.3 billion a year, less than half the total. As such, your percentage more than doubles on that basis alone.

These discussions should then mention that pensions are only one small area of that operating budget in addition to salaries, skyrocketing medical costs, and all the other things a city spends money on. If your fellow employees worked solely for a pension, not the hundreds of millions of dollars in salaries and other costs, your point would make more sense but between fire, police, and all other workers, the percentage of the budget tied to pensions is growing and it is nowhere near a few percent.

As far as that $94 million comment, you should also be aware that if the smoothing process is removed from your pension, it doesn’t cover the full costs by a long shot. Your pension lost a great deal of money in the last two years by not achieving the outlandish 8.5{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} net returns needed. In recent years, for every year your pension fund does well, it has two years of poor results, this leading to an 80{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} funded rate and close to a billion dollars in unfunded liabilities you and your colleagues continue to ignore. As I pointed out this weekend, lowering your discount rate a single point than adds almost a billion and a half more in debt.

Do you still want to argue how well funded and financially sound your pension fund is? It currently costs almost an additional 35{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} to costs and local voters have no say as costs rise. Without changes to all three pensions, roads and other things Houston finances will be pushed out more than they have already so it might not be such a false dichotomy after all, the insulated thinking that your related costs are the only costs that matter just not supported.

Bill King as a conservative, made my day, one only has to read his book, “Unapologetically Moderate: My Search for the Rational Center in American Politics”. He is pro abortion, need I state more.

Jack,

We have had this discussion.

If everyone is complaining about hfd’s pension, why dont they apply for the job. For the low paying, high insurances premiums, super dangerous, full of health problems, and probably not living long after retirement job? Its easy to be a online warrior and being biased, expecially on the one sided info they gather from bill king and his john arnold boy band websites and publishings. Read facks from both sides then come to your own conclusion. You will find out that hfd retirees are not making a million dollars in their drop accounts. I personally will not come close to that.

Jose, the facts presented below came from your own pension website and they directly contradict those you and your fellows offered to the discussion. People have a right to complain when billions of dollars in debt is built up without anything to show for it, if you don’t like the most likely outcome, you should cut your losses and find new employment. I don’t think anyone has a problem discussing compensation models except employees that know the more information the public has, the less willing they will be to give up decent roads, quality drinking water, and other amenities they are led to believe they are paying for solely to allow many of you to live a luxurious retirement.

Would you accept a vote of registered city voters, allowing them to decide what you should be paid and how, including all associated costs such as the medical, disability, pay, pension, training, and whatever else? Local voters don’t care what Austin pays nor what San Antonio pays. If anything, they might agree to comparisons to Conroe, La Porte, and other area communities that often include a large percentage of volunteers that are augmented by paid positions.

Liberal Mayors are the ones to blame. The tax payers voted for them and so the burden lies on their shoulders for elected poor money managers. The fire fighters played by the rules and invested smart and conservative. We are 89{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} funded and have been named one of the best pensions in the country with nearly 4billion in assets. We are getting nothing in return for concessions. Municipal and HPD are getting 1 billion dollars. Tell me how this is fair?!!!! It’s total BS! Turner can just leave us out of it

The average FF….He/she at 17yrs tops out in pay. They make then the same pay as an E/O, roughly…$62K That said FF then works til they get 20yrs in. signs up for DROP and retires at the average age of 54. That means that his/her retirement is frozen at 50{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} of his/her $62K. Which is now a monthly benefit of $2800. (remember this is roughly, like a few $off). Oh don’t forget the insurance that is required by law, cost around $1300 (which he/she will have to pay til 65yrs of age. That leaves him/her $1500. Oh yeah, those dang taxes. There goes another$4-500. Now, he/she is bringing is a whooping $1000. I’m not sure if you guys live in Texas but we pay the highest property tax. mostly due to high cost of school tax. Where I live my taxes and POA dues are now over 9K a year. not counting my insurance. Which all of this was affordable when I bought over 10yrs ago. That comes to almost $1000 per month for all 3 of those cost. His/her total is now $0.00. This doesn’t add food, water, lights, anything else. Also, the average FF works only 8yrs in the DROP. So the lump sum of 1m is much lower than that. So please tell me again where FF are rolling. This is gonna be good. hold on, let me get my pop corn.

Fact: HFD FFs have ALWAYS been good stewards of the city.

Fact: HFD FFs have ALWAYS taken less and given more to maintain a healthy Pension

Fact: HFD FFs are at the bottom of the list on pay. who did not inflate their wages by getting raises

Fact: HFD FFs make more runs (fire,MVAs,cardiac arrest….everything name it) than most FD in the State.

Fact: The City failed to make the obligation payments to the other 2 funds

You correct that problem and 90{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} of Pension problems go away.

I can go on and on about the facts. I do have one last Fact.

Fact: by the time a FF does retire he/she now faces health problems. higher than average cancer rates, Heart problems, Lung problems. Average life expectancy is 59.

Here’s the reality. This isn’t about how much Houston firefighters make, either on the job, or in retirement. For that matter, it’s not really about what the police or municipal workers make. This is about how the City of Houston needs to dig itself out of the massive hole it finds itself in. As long as everyone keep pointing fingers at each other and trying to assess who’s fault it is, or who’s getting too much or too little, nobody will get past that and start arriving at actual solutions.

I will say this, however, for all of you firefighters and police and municipal workers – somebody better find a solution, and it’s possible that the solution may involve some sacrifices on your part. Because, if we don’t solve the problem, one of these days you’re gonna find yourselves with a big fat pension – supported by a bankrupt municipality. What’s the good of a great pension plan with zero funds to actually pay out?

For a long time Houston has looked at cities like Detroit, and Baltimore with a superior, self-satisfied grin, secure in the knowledge that we were better. Well, it turns out that even Houston is vulnerable to venal, self-serving politicians, and complacent voters. We can see the end-result of just kicking the can down the road and playing trick accounting games to hide the problem. Stand up and start actually holding these folks accountable!

Liv-

You asked for some of my notes regarding that HFD pension so I tidied it

up for you:

1. Per their own yearly report;

a. To stay fully funded, they need to earn 8.5{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} net each year but their

10 year average is 7.5{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986}. Their plan notes that lowering the discount

rate by 1{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} adds over $1.35 billion to the city’s debt.

b. Last year they LOST over 1{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} & the year before that they earned less

than 1.3{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986}, taxpayers will end up paying for it over the next 5 years well

over $100 million extra dollars given $4 billion times 8.5{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986}=$340 million.

c. As of last summer, they were 80{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} funded but despite those losses,

benefits increased 8{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} last year and a commensurate amount the year

before, the city owing them $900 million due to the smoothing process.

d. Of the 94 firemen that retired last year, 86 of them averaged $5,110

per month on a final base salary of $5,284, 4 others averaged almost

$4,600 per month. This is due to their spiking provisions and does NOT

include their lump sum payments. There is no connection between fund

performance and benefit increases, every year they get a cost of living

raise (COLA) as well as subsidies on their medical coverage.

e. 91{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} of the cost of these benefits comes from city contributions and

market returns, all risk is assumed by the city for shortfalls and no

benefit cuts appear on record for years with catastrophic losses.

f. Their actuaries are using a common mortality table so there is no

evidence of employees dying any earlier than the rest of us, this not

impacting costs since the spousal benefits are 100{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} upon death. Most

funds provide a markedly lower benefit for such generous spousal

coverage, 75{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} is the most common.

2. If this pension is the best funded of the three, without large cuts

to benefits, there is no way for the city to catch up given an operating

budget of $2.3 billion. Previous cuts to the other employee groups have

resulted in a yearly municipal attrition rate of over 14{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} but firemen

show less than 2.4{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986}, so those 9 days a month do not appear to be too

burdensome. Is this a good time to discuss my own review? 😉

-Spencer

Spencer (seems he’s doing the legwork),

A) 8.5{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} is the current discount rate. I agree that’s too high. It should be lowered, but still that just demands more money from the city. On the flip side, the other assumptions are for 3{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} inflation. I think in the last decade there have been 2 years where the CPI exceeded 3{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986}. I think I read it assumes for 3-7{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} in salary increases.

B) Fortunately we have a 5 year smoothing process. It is true that the fund lost 1.2{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} and only made maybe 1.3{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986}. You forgot to mention that it made 17{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} and 11{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} in the two years prior.

C) 80{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} funding is the actual benchmark pensions seek to attain. It’s very misleading to say benefits increased 8{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986}. The implication is that individuals who are retired are now taking home 8{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} more money. In fact what it means is that a greater amount of money was being sent out to retirees and disability pensions. It is the case that there was an increase in disability pensions. The May 31st fire which, in the end, resulted in the death of 5 firefighters also injured an additional 12. I’m not sure as to the exact number, but several of those ended up with medical disabilities as a result of those injuries.

D) COLAs are not tied to market returns typically. Do you get social security? SS recipients received COLAs of 14.3 and 11.2{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} in the 1980s. I guarantee you they didn’t make more than 4 or 5{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} those years.

Also of note, a bunch of hay has been made of percentages in this discussion. 30{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} of payroll, maybe 50{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} of payroll! ETC ETC. 30{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} of next to nothing is just that – almost nothing. Under HPD’s current pension plan, it is more difficult to get the higher percentage pensions, but with their salaries, across the board being 30{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} higher than their FD counterparts, they end up with a similar total pension along with a career of much, much higher wages. Most of the people fixating on this are the same type of people who struggle with the age old questions of if a pound of lead or a pound of feathers is heavier.

E) Or you could say employee contributions and market returns pay for nearly 80{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} of benefits. Of course all the risk for market shortfalls is born by the city. That’s literally the definition of a defined benefit. You define a benefit. Employees contribute X amount. City contributes y amounts + whatever else is required.

F) I can’t speak to the specifics of the mortalities tables used. However, it seems to me that by using one common to the general population the board would be taking the conservative route i.e. fiscally responsible by assuming we live as long (when all signs point elsewhere). Go look at the CDC’s publications on cancer prevalence amongst fire service personnel.

Survivor benefits are high. I’m not sure about the background behind that.

G) Spencer, you have some serious snark. Kind of unbecoming but that’s neither here nor there.

The low attrition rate is so low for several reasons – both structural and artificial. I know the city does not track the number of members who leave before starting “pensionable” service. This has varied, but it hovers between 15-18months after hire date. So anyone who leaves before 18 months on the job is not counted. I know union officials are now tracking this as there has been a large upturn in recent years, and those that leave before getting off probation (that 15-18 month time frame) are an order of magnitude greater than those off probation.

Additionally, TLGC 143 does not allow for firefighters to be hired after the age of 36. With how sparingly departments hire (usually no more than once in a year, more often every 2-3 years) and how long the process is (6-24 months) one really can’t seek out other fire service jobs after the age of 33 or so. If I work for a mid level oil company, and word comes down that my total compensation will be slashed 30+{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} I can simply shop the market. If you are a firefighter, you literally have nowhere to go. Further exacerbating the issue, is the vesting schedule on these “lavish” pensions. If I leave after 8 years, I’ll get back my own contributions, no returns, and none of the city’s contributions. If I leave after 10 years, but less than 20 years I would get back my own contributions, 5{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} simple interest on those contributions, and no city contribution. These don’t even comply with the minimum vesting schedule on ERISA compliant qualified plans. What a joke.

This isn’t entirely unique to a job seeker, but what is unique is that there is no “free market” for labor so to speak in the fire service in the state of Texas. If I leave the city of Houston I’ll be done with the fire service and the public sector as a whole. Before the debacle in Dallas began to unfold over the last 2 years, I always contended that Houston FD was objectively the worst big city FD job in the country. Despite that, I really invested in the career using my vacation (any other city grants paid leave for relevant degree programs) and my own money (most FDs and even our PD) have tuition reimbursement) getting an MPA. Fortunately for me, I have a wife could fund a family if I need to go back to school to make a wholesale career change.

The firefighters who are screwed the most, are the guys who are 35-45 who enlisted in the military at the age of 18-20, entered the department at 25-30, don’t have a degree nor have the ability to seek greener pastures as they can’t get hired at another FD nor can they take hardly anything with them from the pension.

Mr. Rhem,

As I pointed out above, you truly are making my case for me. Using your lettering process to reply:

A. We agree that your pension requires too high of a return given current market conditions. Your pension board points out that lowering the rate just 1{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} which makes it your ten year average, comes with a price tag of over $1.3 billion. Under the current plan, tax payers are responsible to make up the difference but under the new plan, they would only be responsible for a portion of that. This is more reasonable to those paying the bills.

B. Your fund also had a terrible year before those two good years, the larger point made here is how volatile your returns seem to be. As a result, your plan is still nearly a billion dollars short and without changes, taxpayers will be responsible for that billion and in a very short time frame unless changes are made. At least with some reasonable cuts to benefits and that corridor provision you hate so much, the required rate of return is lowered as you agreed it should be and future losses will be shared.

C. I believe Spencer mentioned the funding level as 80{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} to respond to the ever frequent comment by firemen and their supporters how their fund is either 94, 93, or 89{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} funded. This is not true, nor are most of the numbers espoused when discussing this matter, your own spin only slightly better. Without changes, taxpayers will be responsible for paying an additional billion dollars and likely a great deal more as the markets are predicted to be ready for another major adjustment, the last few years of incredible growth a time when your pension fund lost money 3 out of 5 years, lost in this case referring to greatly overestimating your ability to make the stated amount. A more conservative number would be 5{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} but of course your pension board would never accept the needed cuts for that, would they?

D. A conservative approach ties benefits to returns. A liberal approach ties benefits to employee greed. As I do not receive social security, it is a false comparison point but if you would like your COLAs tied to that program, you are in luck because that is one of the new provisions as I understand it. The continued comparison to police is another mistake, what you take for granted has yet to be proven or accepted here. In your responses above, you said: “The comparison between police and fire has been settled many times over in many municipalities. For being different professions they couldn’t be more similar. Education requirements, dangers, work hours, etc.” and then later question my response how your work hours are completely different, your educational requirements are not the same and the dangers are markedly different yet you continue as though we were in agreement. You have different jobs, different responsibilities, and different work rules that may or may not justify different pay scales but comparing one to another seems fruitless when you admit they are underpaid and greatly understaffed.

E. Reducing the risk to city coffers reduces the exposure to taxpayers. You want all risk borne on their backs and Conservatives think you should share in the risk. The new plan will do this.

F. Many people survive cancer. The point was addressing the common refrain from your side as to how so many of you die immediately after retiring, as though that lowered costs when it does not. You have a 100{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986} spousal benefit so as long as one of you is still alive into their 80’s, the costs and yearly COLAs remain. Very few people have this luxury benefit as it is an expensive perk.

G. Texas is a right to work state and pay can be determined in part based on factors that favor either side of the equation. Some factors favor the employee and some favor the employer. Whatever faults your city leaders have with regard to spending too much, they are the representatives of the voters that elected them. If voters want more bike trails and parks instead of secure employee pensions, that is their choice. If you are unhappy with that fact, you can find new employment but just as I contend your voters should have the right to vote on any bonds, they should also have the right to decide if they want to sacrifice all else to fund generous pensions.

Spencer is a talented employee that is independent of the situation. He neither lives in the city limits nor is he a fireman so he can be more objective than you in his analysis. Given the lack of honest figures and the amount of spin so many of your people project everywhere they go, I will make sure his information is provided to those in the legislature to assist you further, though a number of them read this very blog already.

The real reason Houston can get away with paying fire & police less than other sizable cities is because it has a tradition of encouraging both to accept the need for moonlighting, I know because I’ve hired officers myself at times. Their culture is to make it an expected fact of life from the very beginning of their careers which allows them to start families and then become dependent on all their work to stay afloat. Because of this, the employees are tired all the time and not always at their best but no one questions it or the greater rates of divorce and medical ailments that follow. By the time a worker is vested in a pension, they are locked into remaining too so the lower pay just becomes another tradition leading to burnout.

In speaking of the ROI’s these plans need, you can’t have it both ways: you either accept that lowering the rate to below their real world averages which makes the yearly goals easier to make but increases the liabilities, or you set them closer to where they average out which lowers city costs and the stated liability numbers. You could also demand they use Treasury Bills to stabilize their funds which eliminates most risk except the returns would be so low that few would be interested in working for the city. As Jack points out, there are good years and not so good years but they average out higher than what some believe is possible, some room for compromise a given thanks to market changes.

And I think Jack’s point about work hours dealt more with the need for both groups to engage in shift work, ie: working at night or other odd shifts most private sector workers don’t have to accept as a condition of employment. The CDC commissioned studies proving this kind of work is unhealthy but the modest amount of shift pay some get is laughable as compensation. What I believe is the elephant in the room regarding firemen is the belief that so many of them get to sleep a lot on their shifts but in a city like Houston I doubt that is as likely given the frequent use of most personnel as EMT’s to stabilize those in need before an ambulance arrives. Should that fall on the employee for organizing the dept in an inefficient manner or on the dept responsible for not maximizing resources? I agree they have much in common as well as big differences but the reason “public safety” is so frequently lumped together is the overall nature of the work.

And why is it a crime to some of you for the various groups to use the legislative process as it was designed and hear from a variety of those affected by legislative proposals? Maybe some in Austin should ride on a pumper or ride shotgun in a squad car in a terrible part of town for a full shift before being so quick to judge how much pay is right for these jobs. Houston is full of people that demand all the services one can get from a government yet don’t want to pay for it which leads to problems like these. Let them vote and then proportion city services based on the numbers. Areas that vote to save a few bucks can fund their own street lighting, have fewer fire stations and less police assigned to them, just like the county saves money. After all, isn’t the belief of the day that “elections have consequences”?

At the hearing in Austin today, the comments were all over the map. Turner and City Councilmen spoke in favor of their pension changes but not bond votes then municipal workers spoke in favor. The cop union came out against bond votes and stayed very positive toward municipal and fire workers. Then the firemen spoke in opposition to substitute HB 43, much more willing to attack the other two groups with a few exceptions. Everyone was very polite but there didn’t appear to be any feedback from the committee that comments would change anything.

I’m not going to attack the numbers coming from the annual report posted above. They are what they are as listed in the report but they are only a snapshot of finances. Those finances change every year and some years show double digit returns. Maybe this year will have better results or next year but pensions don’t invest too much in stock because they are unpredictable.

It’s a sad day when outsiders try to influence deals made for other jurisdictions, the promises made to all three pension funds should be kept for existing members and then change for new employees if those benefit levels are too much to sustain moving forward. David Keller and the board are fighting to hold the city to what was promised, showing example after example of how Turner and his cronies keep spending money on every pet project under the sun but don’t cover the basics, 550 million on bike trails, 10’s of millions on solar energy above market rates, and every boondoggle under the sun while claiming to be too poor to fund the basic cost of employees like pensions.