(This post needs a bit of context. On Friday, October 7, Stat Sen. Paul Bettencourt sent a press release about the Harris County property tax rate. I didn’t think much of it because lowering property taxes is Bettencourt’s mission in life. Then I received a call from a down ballot Republican candidate frantic that Bettencourt was undermining the Harris County Republican Party’s Harris County Works marketing slogan. There is your context.)

Does Harris County Work? On the surface, it seems as though State Sen. Paul Bettencourt doesn’t think so. He has a beef with the Harris County Commissioner’s Court and their tax rates. From his press release, titled “Sen. Bettencourt Busts Another Property Tax Myth, that ‘I Did Not Raise Your Taxes, Because I Did Not Raise Your Tax Rate’“:

Major urban areas in Texas are experiencing rapid taxable value growth and, in the past, the vast majority of cities and counties generally leave their rate unchanged or only cut it slightly, taxpayers’ tax bills have increased. In Harris County, for example, the taxable values have increased by $117 billion between 2011 and 2015, resulting in a nearly 53 percent increase in the county’s general fund property tax revenue or a calculated $568 million. During the same time frame, Dallas County’s taxable values grew by $33 billion, a 21 percent increase. Since Dallas County left their tax rate unchanged from 2011 to 2015, taxpayers paid 21 percent more by 2015 than they did in 2011.

“Dallas County Judge Clay Jenkins made a true attempt to cut the tax rate this year in his county, but lost the vote 3–2. Harris County, the largest county in the state, has not set its tax rate but publicly noticed an overall no change in the tax rate. Harris County should follow the lead of the other tax rate cutters,” Sen. Bettencourt added.

Click here to read Bettencourt’s press release.

Timing

It isn’t surprising that Bettencourt would be talking about property taxes. After all, property taxes have been his signature issue through the years and he makes his living off of protesting property tax appraisals. What is surprising is the timing, thirty days before a critical election, and the target, Republicans that control Harris County.

I mean, seriously, don’t you think that Harris County Republicans have a big enough problem in front them without infighting? So why now? Well, there’s actually a good reason for the timing. From Bettencourt spokesman Robert Flanagan:

Harris County Commissioners have not currently proposed a tax relief plan, and are currently in their tax rate setting process (three meetings: October 4, October 11, and October 19), which makes this the best time to comment.

Okay, I get that Tio Pablo is trying to influence the commissioners to set a lower rate but he knows he isn’t going to change their minds. I mean, seriously, he knows that more than most because he’s been an insider on this issue so long. But that is my opinion. He doesn’t set the tax rate calendar, he has to live by it like the rest of us. So he really had no choice.

HCRP Marketing of Candidates

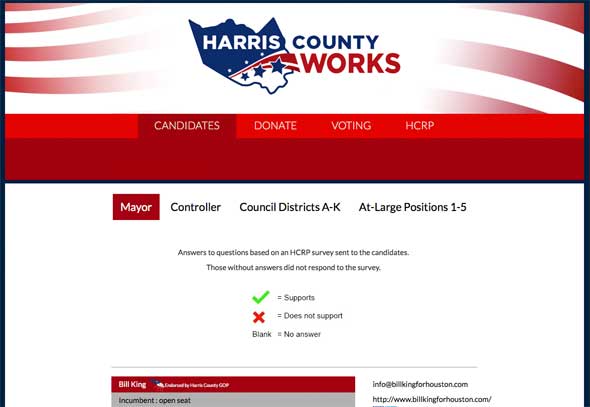

But even more than the timing, think about the HCRP’s slogan – Harris County Works. Remember that? They even have a website:

Although it hasn’t been updated since last year’s city elections even though we are less than 30 days away from this year’s presidential election (how sad is that?):

But they are still using the slogan on the Republican Judges website, which is current for this year’s election:

If I were on the Harris County Republican ballot and spending my life’s savings, I’d be a bit upset about this, especially coming from a high profile Republican leader. So I can understand the frantic call that I received.

Property taxes are burdensome and not the most effective way to fund government but that is a subject for another day. Harris County is unique among counties in the country because of the large unincorporated area and the large population in that unincorporated area.

Commissioners

Harris County Judge Ed Emmett had this to say about the press release:

He seems to be busting a myth that only he knows about. Of course taxes go up with increased appraisals even if tax rates stay the same.

- I wish he would take steps to change the appraisal process.

- I wish he would allow federal and state funds to pay for indigent health care that is now paid for by county property owners.

- I wish he would meet with county officials and seek real solutions.

- I wish he would recognize that we have completely exempted the first $200 thousand appraised value for Harris County senior citizens.

- Most importantly, I wish he would discuss fundamental change to the flawed property tax system so urban counties do not have to rely on it.

Since he represented Harris County for years on the Harris County Appraisal District, I would like to know why the appraisal process and appeal process is still so bad. I sincerely want to work with him and the Legislature on real reform.

Interesting points from the Judge.

Precinct Two Commissioner Jack Morman was light hearted about the issue, telling me that if Bettencourt can get something done in Austin that will make it feasible for him to lower property taxes, he’s all for it and wishes him success. Morman noted that he too pays property taxes. I asked him if he thought that the budget was fat and bloated. He pointed out that because the two biggest issues for the county, criminal justice and indigent health care, are not discretionary and must be addressed by the county, there is relatively little money left for quality of life expenditures.

Morman also pointed out that the unincorporated part of the county is almost as populous as the City of Houston. You can read more about that in these two Houston Chronicle articles: Visualizing the country’s fifth largest city and Growing pains: Unincorporated Harris County population expected to swell past Houston’s. The swelling population, combined with the fact that the county doesn’t have a sales tax or receive franchise taxes, increases the burden on property taxes and highlights the need for serious property tax reform.

In short, Emmett and Morman think that Harris County Works but that Bettencourt could help make it work even better. And both are willing to help him.

Bettencourt’s views

As for Bettencourt, he said he is ready and willing to help. And that he has talked to the commissioners and that his door is wide open if they want to meet to discuss property taxes.

We went over Judge Emmett’s points above and here are Bettencourt’s responses.

- Appraisal process reform is part of his agenda for overall property tax reform.

- Harris County opposed SJR 61 introduced in 2013 by Sen. Charles Schwertner that would have required local property taxes to be cut if the state accepted funds from the PPACA (Obamacare). I looked it up and he’s correct – click here for the witness list and note that Harris County registered to testify against it. Obviously, even if the legislature did receive funding from Obamacare, the Harris County lobby group was tasked with defeating the attempt to offset those local taxes.

- Bettencourt said that he had met with several Harris County Commissioners and has an open door if they want to meet at any time.

- Bettencourt gave an example of a senior that had property appraised at $162k, it went up to $234k, now the senior was paying taxes. Thus the shared concern about the appraisal process.

- Bettencourt said that he had invited Judge Emmett to testify at one of his hearings but that the Judge had a conflict on his calendar. This was the first time he had heard after 50 hours of public testimony that urban counties wanted a different tax system that didn’t rely upon property taxes.

Bettencourt’s biggest concerns are that Harris County’s property tax revenues have increased by $568 million in four years, the increase of 53% is far too high, and that the county is the most solvent county in Texas with the revenue stream being used to build up reserves. Lowering the property tax rate by a penny will not stop the inflated property tax revenue stream from continuing to build the reserves but will provide relief to the 30,000 laid off workers in his senate district.

So what’s the deal?

Obviously with an issue this complex, there is no way that I can put every argument into one blog post. But I do need to try and answer the frantic question posed above: will this undermine the Harris County Works campaign?

I think the answer is no. All we have here is a disagreement between two camps on revenue. It is a major disagreement, a fundament disagreement, a philosophical disagreement between good, solid, conservative Republican politicians but not one that will hurt down ballot candidates.

And if anyone thinks that Tio Pablo isn’t going to help the local effort, rest assured, he is. He told me that he sent out 145,000 robo calls today asking Republican voters to vote straight ticket.

Apparently the County budget is bloated and fat enough to spend millions transitioning the Astrodome into a glorified parking lot.

“I wish he would recognize that we have completely exempted the first $200 thousand appraised value for Harris County senior citizens.”

Memo to Judge Emmett: this is hogwash and just a way of paying off favored groups to keep them from torching the county offices. Seniors, vets, disabled, spouses of many of the same. Divide and conquer, eh Ed?

I wish the County government would recognize that those of us who live in the various cities pay County taxes, and deserve more benefits than we currently receive. For example, if you live in Houston, the County animal shelter won’t accept a stray you find. That’s ridiculous, since I pay as much on County taxes as those who live in the unincorporated areas.

I bet the HCSO won’t show up at my house if I call for service, even though I pay the same taxes as those in the unincorporated areas.

I don’t see the County spending money on roads in my apart of the City of Houston, even though I pay the same taxes as those in the unincorporated areas.

etc, etc, etc.

I have read that in the first years after a state adopts an income tax other taxes are lowered. That is part of the deal made with taxpayers. After a few years all tax rates start to rise by small increments Therefore, I believe that if Harris County gets the power to assess a sales tax the property tax rate will drop … but eventually rise.

One potential source of income is the Toll Road Authority. Currently all its revenue is used to build more roads or upgrade roads. Aside from money needed for overhead and debt service that revenue could be deposited in the general fund.

The promise that was made to Harris county residents was that the tolls would only be used to fund construction of the toll roads. And, when the toll roads were paid off there would be no more tolls.

Once again, the solution here is for government to spend less, not find endless ways to dun the taxpayers for ever more spending.

As for the idea of an income tax – what a fabulous way to kill our economy and drive away employers!

I hope everyone sees Judge Emmett’s attempt to obfuscate the blame for Harris County’s massive annual property tax increases on a flawed appraisal system for what it is. For years now the county has been building its financial position to unneeded levels at the expense of its taxpayers. The appraisal system can certainly be improved, but at least taxpayers have the ability to protest their property appraisals at multiple levels. Their complaints to the County Commissioners just fall on deaf ears. If Judge Emmett is really concerned about high property taxes, why doesn’t he rally the commissioners and do something.. I think we know the answer, the commissioners are perfectly content to have the extra property tax money to laud over.

This year the County is likely to take in $156 million more than last year when taking into account $12 billion in new property. $104 million will find its way into the General Fund, not the Hospital District, Port Authority or Flood Control. The property tax on the average home will increase 9.2{997ab4c1e65fa660c64e6dfea23d436a73c89d6254ad3ae72f887cf583448986}. The total increased property tax is the equivalent of a 4 cent property tax rate increase over last year.

Knowing this, I ask why is it bad for Republican State Senator Bettencourt to be seeking lower property taxes in an election year. Why wouldn’t giving the taxpayers a 1 cent reduction, one fourth of the total increase, be a good thing to help get Republicans elected. Let’s face it, the federal government is not the only government with an establishment that seeks to avoid accountability and transparency. We have a good example right here in the county.